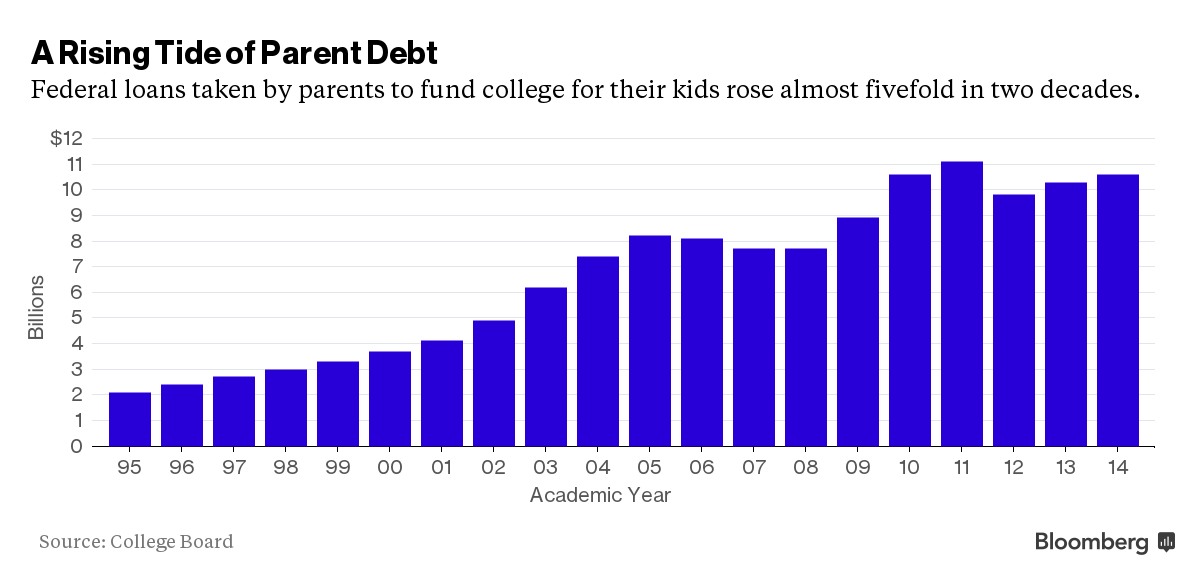

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

Wondering what to get the millennial in your life this Christmas?

Consider giving them something they probably need: a gift toward their student loan payments.

According to MarketWatch, a new site called LoanGifting allows family, friends and others to make payments directly toward someone’s student loans.

The government recently dropped some huge news for those with federal student loans.

Starting Dec. 16, all federal student loan borrowers will be eligible for an alternative repayment plan called Revised Pay As You Earn (or REPAYE), MONEY reports.

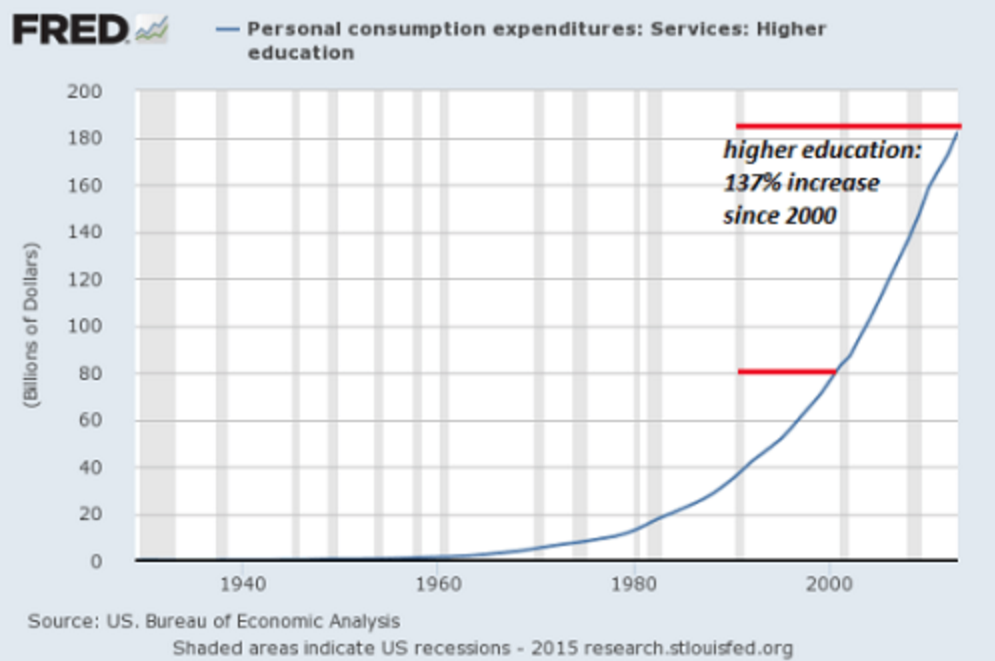

It’s well known that the student loan crisis has gotten out of control and continues to grow every second. According to Business Insider, student debt has skyrocketed from $500 billion in 2006, just 9 years go, to over $1.3 trillion today. Many people in government have proposed student loan forgiveness and other strategies to help reduce […]

As financial aid and student loan consultants, we help families figure out how to pay for college and help graduates manage their student loan debt. Student loan consultancies are on the rise due to high student loan debt, but all aren’t created equal. Some companies have even faced lawsuits for misleading students and taking advantage […]

The average college graduate now leaves school with $30,000 in student debt, and the national student debt total of $1.3 trillion is rising every day. Many prospective college students don’t realize the huge impact student debt can have on their lives–and how much compound interest can add up over time, resulting in a much larger […]

We write a lot about the country’s rising student loan debt and the fact that it’s already over $1.3 trillion, as well as the effects it’s had on the economy and borrowers’ lives.

But it’s a lot different to actually see it grow by the second. MarketWatch has created a national student loan debt clock to help people visualize just how quickly student loan debt is growing, and it’s pretty sobering to watch.

In fact, by the time you finish reading this post, it will likely have grown by $366,600.

With 70% of college graduates now leaving school with debt and the national student loan debt now at $1.3 trillion and growing, there have been many proposed solutions on how to combat the country’s student loan problem. According to Martin O’Malley, the former governor of Maryland, the federal government must act swiftly to stop the student […]

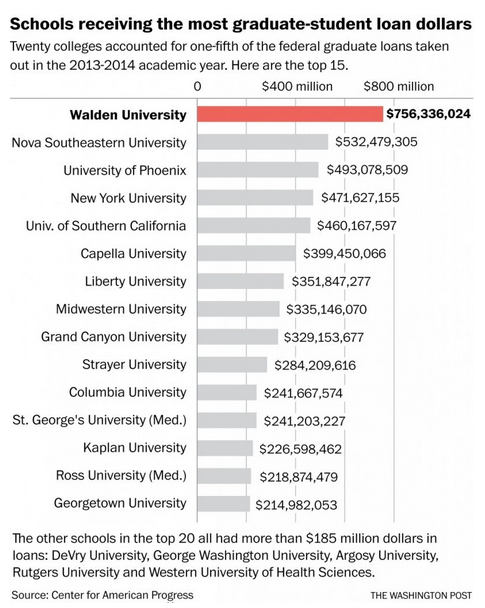

We’ve written before how graduate school debt has a huge impact on the total amount of student debt in the U.S.

Many students, unable to find a high-paying job after college, think that graduate school is the answer–only to face the reality of high debt and a minimal increase in salary and job prospects.

And according to a new study from the Center for American Progress, as reported by The Washington Post, a small number of schools are responsible for a large portion of the student debt problem.

Most parents look forward to their children graduating from college, as it marks the time in their lives when they can start becoming real adults and taking care of themselves–moving out, finding a full time job, and potentially getting married, having kids, or buying a home.

But a recent study from the University of Arizona, as reported by CNN Money, has found that that’s not the case for more than half of recent college graduates, who report they still depend on their parents for money.