Student debt continues to be a major issue for college students and graduates in the U.S.

U.S. total student debt is now over $1.4 trillion, and the average debt for a college graduate in 2016 was $37,000. And 44 million Americans now have student debt to their name.

The video below gives tips on how student loan borrowers can avoid falling behind on their payments. It also explains why millennials should be saving for retirement even if they have student debt.

We’ve written before about how student loans, unlike other forms of debt, can’t be discharged in bankruptcy–which is why it’s so important to be careful about how much you borrow.

Bankruptcy law says that, without proving “undue hardship,” a borrower can’t discharge a loan made for an “educational benefit.”

Recently, however, bankruptcy courts have started ruling in favor of some student loan borrowers and have allowed them to discharge their debt, according to The Wall Street Journal.

Student loan debt isn’t just a problem for millennials. It’s following baby boomers into retirement as well.

The government has collected about $1.1 billion from Social Security recipients of all ages to go toward unpaid student loans since 2001, including $171 million in 2015, the Government Accountability Office said in December.

It just keeps getting worse. Student debt has topped $1.4 trillion, nearly more than all of the credit card and car loan debt in the U.S., according to NBC 12. And that number is growing by the second, leading many borrowers to question whether college was worth the cost. Student loan debt a widespread problem The problem is […]

Getting into college is exciting–receiving the envelope and imagining your future. But not all colleges are created equal.

For-profit colleges, in particular, have been criticized for being dishonest about graduate employment statistics and leaving students with lots of student debt. Some have even gone bankrupt after being fined or sued for misleading students.

To help students better understand the risks, NerdWallet and USA Today College put together a list of 5 things to consider before choosing to attend a for-profit college.

We’ve written about the consequences of not paying your student loans, such as having your wages garnished and your credit damaged.

But it turns out the repercussions could be much higher. According to the NY Daily News, a man in Houston was recently arrested by seven U.S. Marshals armed with automatic weapons for not paying a $1,500 student loan from 1987.

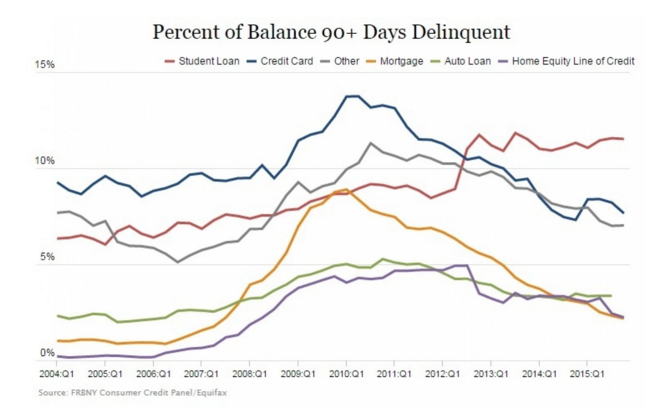

Despite the many alternative repayment plans available, Americans are behind on their student loans more than any other kind of debt.

A new report from the Federal Reserve Bank of New York finds that borrowers are having a much harder time paying off their student loan debt than their credit cards, mortgages, and car loans.

With the national student debt now at $1.3 trillion, and thousands of borrowers in default, some borrowers are going to great lengths to avoid paying back their debt–including moving to a whole other country. Hiding from student debt collectors abroad An interesting new article from VICE takes a look at the many Americans who have moved […]

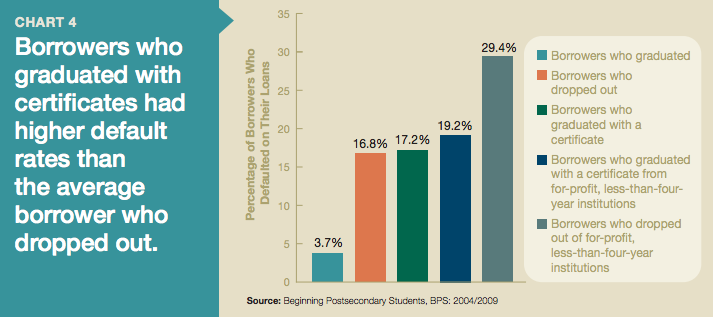

Dropping out of a college, in general, makes borrowers more likely to default on their student loans, because it makes it more difficult for them to find a good-paying job and afford their student loan payments.

But certain college dropouts have it worse than others–those who dropped out of a for-profit, less-than-four-year college.

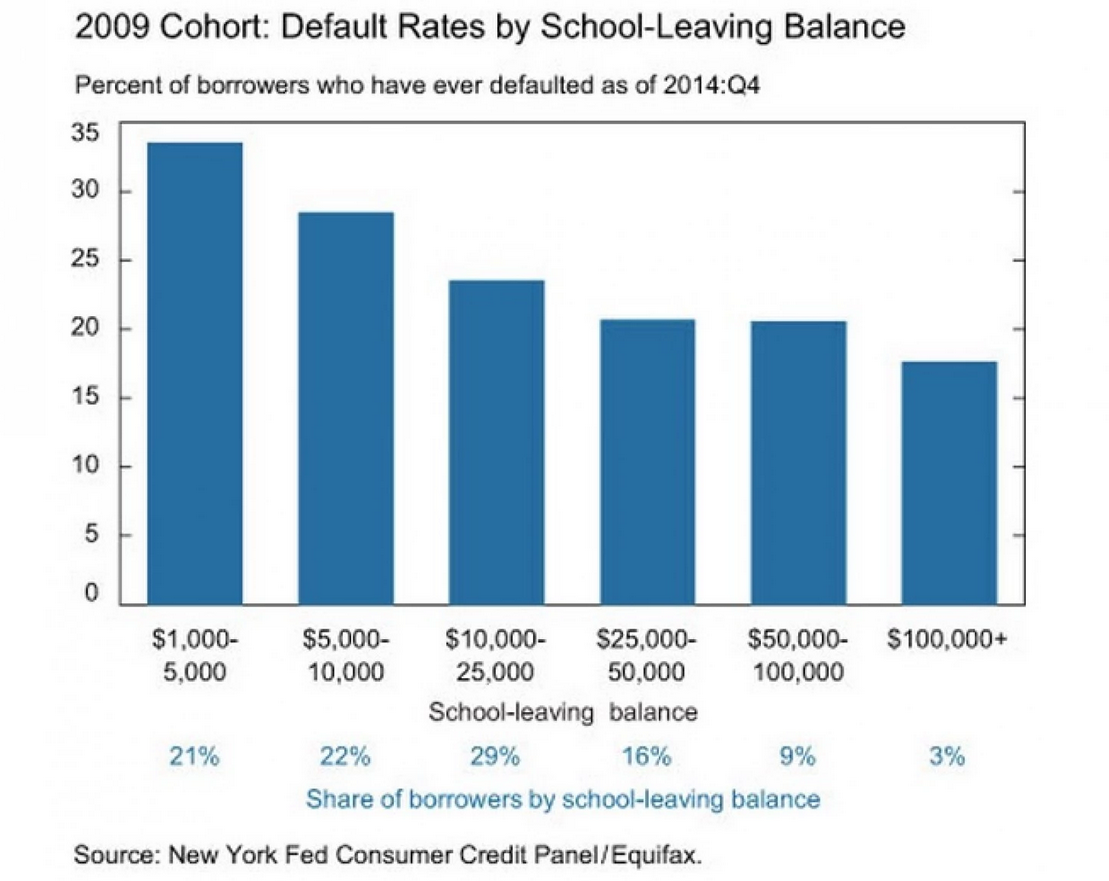

One would assume that graduating with a high level of student debt would put a borrower at greater risk of falling behind on their payments and defaulting on their student loans.

But a new report from the Federal Reserve Bank of New York found the exact opposite to be true.