Most parents look forward to their children graduating from college, as it marks the time in their lives when they can start becoming real adults and taking care of themselves–moving out, finding a full time job, and potentially getting married, having kids, or buying a home.

But a recent study from the University of Arizona, as reported by CNN Money, has found that that’s not the case for more than half of recent college graduates, who report they still depend on their parents for money.

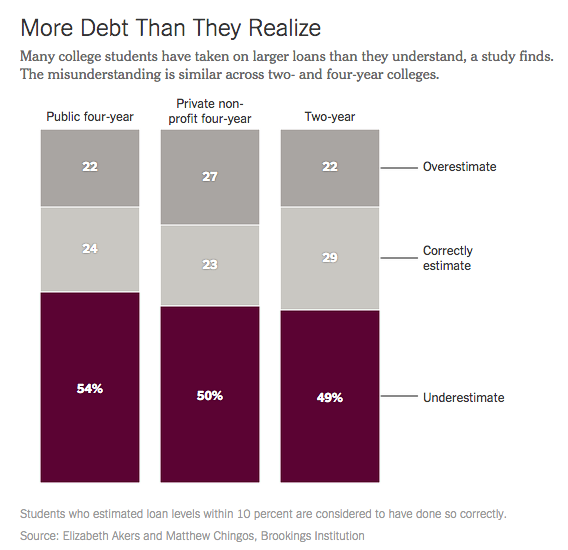

When most students enter college, student debt is a far thing from their minds. They’re more likely to be concerned with classes, making friends, and adjusting to a new place. Since most students enter college as young adults, it’s difficult for many to grasp how student loans work and the consequences of taking them out. But […]

It’s no secret that student debt is a big issue for millions of Americans. We’re constantly hearing scary statistics about the rising amount of student loan debt (currently over $1.2 trillion) and how many borrowers are struggling to repay their loans.

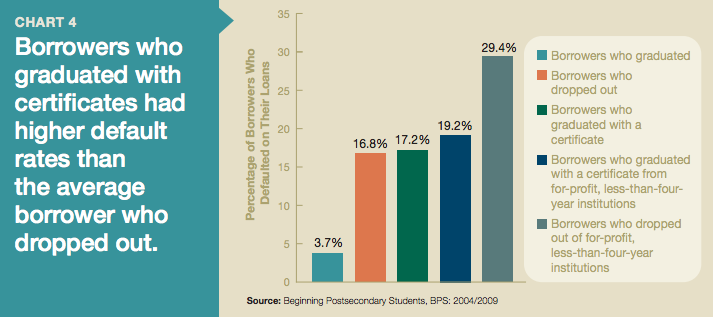

But a recent study, as described in U.S. News & World Report, showed that three types of borrowers are struggling the most and accounting for a large part of the high numbers we hear associated with student debt.

Dropping out of a college, in general, makes borrowers more likely to default on their student loans, because it makes it more difficult for them to find a good-paying job and afford their student loan payments.

But certain college dropouts have it worse than others–those who dropped out of a for-profit, less-than-four-year college.

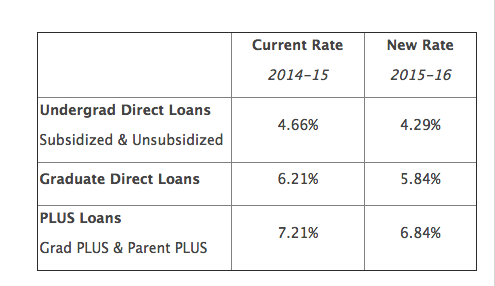

While college costs continue to rise, there’s some good news for students who will be enrolled in college this fall: lower student loan interest rates.

Interest rates on federal student loans for the 2015-16 school year will drop by more than one-third of a percentage point, according to Inside Higher Ed.

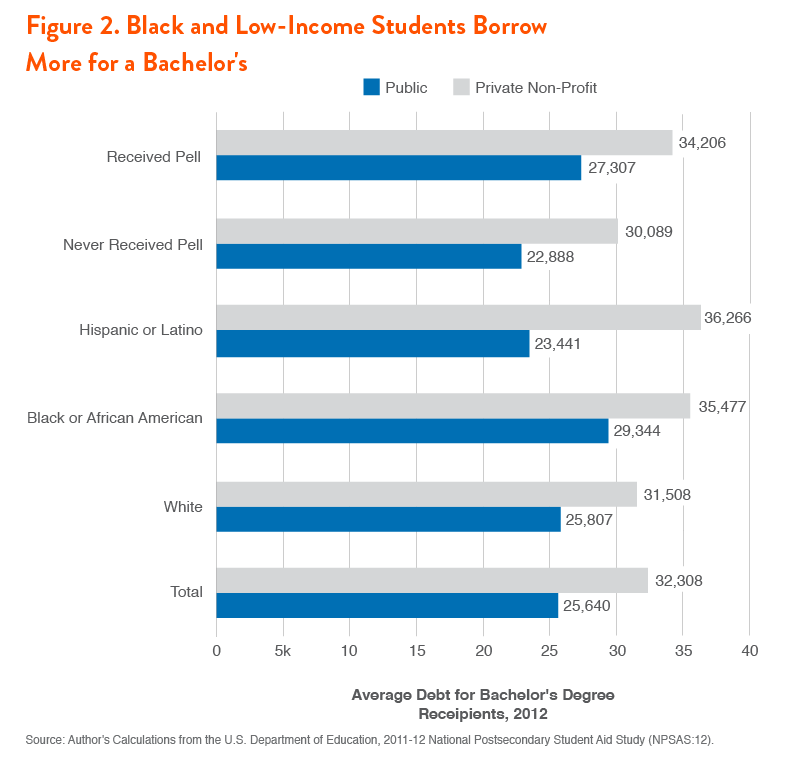

Need-based financial aid, particularly in the form of Pell grants, is designed to make college more affordable for low-income students who may not otherwise be able to attend college. But a new study, as reported by the Washington Post, finds that the students who need financial aid the most are the ones who end up with the most […]

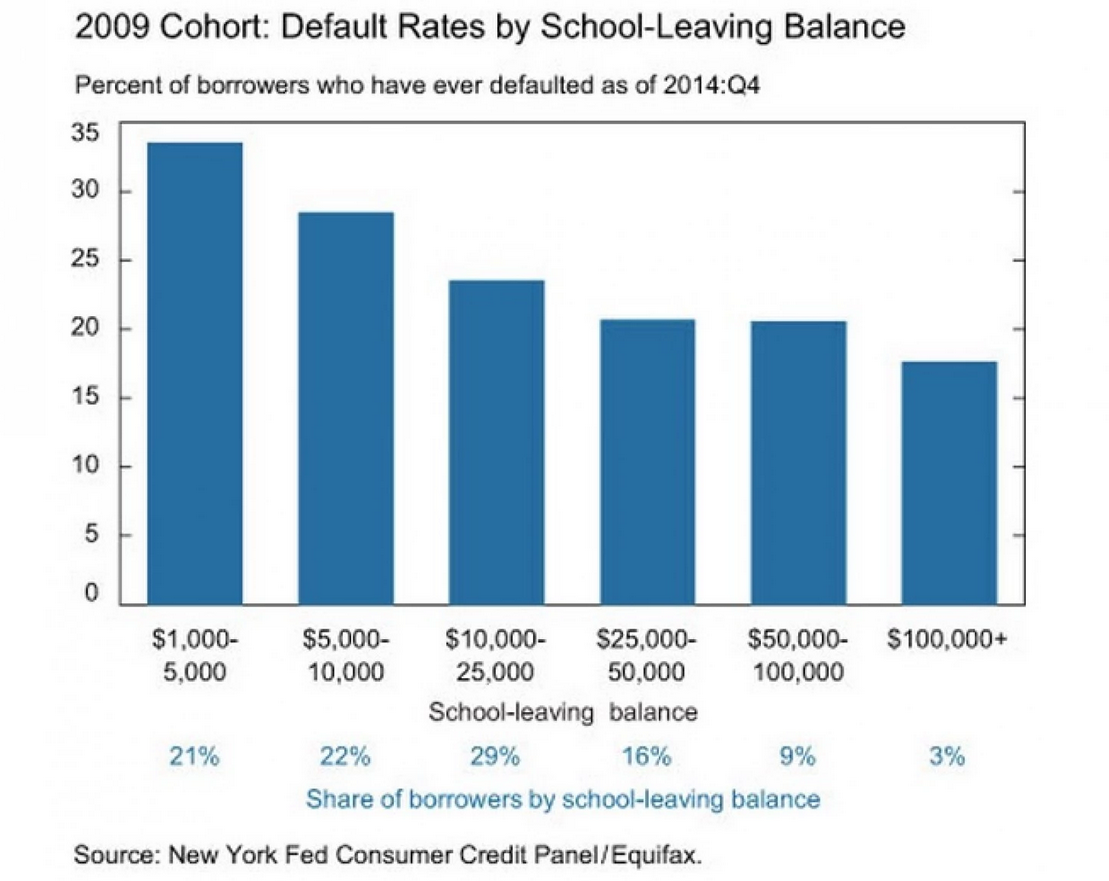

One would assume that graduating with a high level of student debt would put a borrower at greater risk of falling behind on their payments and defaulting on their student loans.

But a new report from the Federal Reserve Bank of New York found the exact opposite to be true.

Over 100 students who attended the now-defunct for-profit Corinthian Colleges system are striking out against their former college and refusing to repay their student loans.

The students are attempting to pressure the government into forgiving their debt, alleging that the colleges didn’t hold up their end of the bargain–by providing a subpar education and not preparing them for a post-graduate career.

By now, most high school seniors have heard back from the colleges to which they’ve applied. And many, unfortunately, are likely disappointed with the financial aid package they’ve received from the schools of their choice. In many cases, students find themselves heartbroken over not being able to attend their top-choice college because their family can’t […]

Applying to and getting into college puts enormous pressure on students and families. Many students believe they need to get into the “best” (highest-ranked) college possible in order to have a chance at getting a good job after college.

Particularly among the wealthy, there’s often competition between parents as their children apply to the same prestigious colleges, Robert Reich writes in a recent piece for Slate.