Public Service Loan Forgiveness (PSLF) is a fantastic program is you can qualify for it. PSLF forgives the remaining balance on your federal student loans if you meet certain requirements, which include working full-time in a public service position while repaying your student loans.

The program is in danger of being cut in President Trump’s latest budget. However, this change would only apply to student loans taken out on or after July 1, 2021. Therefore, if you’ve been making payments under this program up to this point, you are still eligible.

Student debt is at over $1.6 trillion. That’s a lot of money that needs to be paid back to the federal government, lenders and college.

But what if it didn’t have to be paid back? Where would it go?

According to economists, it would go toward spending, like purchasing homes, cars and other necessities. All of this would help boost the economy, they say.

As a Western New York-based business, we love seeing Upstate New York colleges making positive changes — especially when it results in lower student debt.

Colgate University, a prestigious college located in Hamilton, NY, recently announced a new no-loan initiative for students with a total family income up to $125,000.

A new bill passed by Congress will make it easier for student loan borrowers to qualify for student loan forgiveness, CNBC reports.

The bill gives the Department of Education $350 million to offer forgiveness to student loan borrowers who meet all requirements for public service loan forgiveness except that they were enrolled in graduated or extended repayment plans, which were ineligible for relief.

Since it’s now been six months since May college graduates left school, it’s time for them to confront the reality of paying off their student debt. The end of the student loan grace period means that students will start receiving bills from their student loan servicers.

Here’s how to take control of your student debt once your grace period is over — and what you can do before to make it easier.

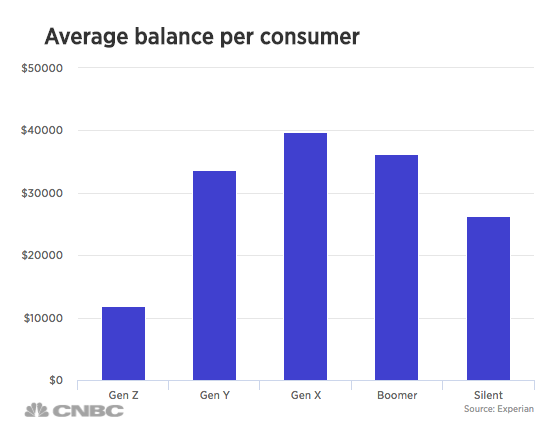

Student loan debt has hit $1.4 trillion nationally, and there aren’t many positive signs that it will decrease anytime soon. Over the last 10 years, student loan balances in the United States have increased more than $833 billion — a jump of nearly 150 percent, CNBC reports. Record student debt for borrowers The average student […]

Student debt continues to be a major issue for college students and graduates in the U.S.

U.S. total student debt is now over $1.4 trillion, and the average debt for a college graduate in 2016 was $37,000. And 44 million Americans now have student debt to their name.

The video below gives tips on how student loan borrowers can avoid falling behind on their payments. It also explains why millennials should be saving for retirement even if they have student debt.

The second post in our student loan refinancing companies series focuses on Credible, a student loan refinancing marketplace that gives you access to multiple lenders with just one application.

Credible doesn’t do any lending itself, but rather aggregates personalized offers from different lenders, including banks and online companies. This allows you to apply for refinancing with multiple lenders all in one place.

With private student loan interest rates on the rise, and the high cost of college forcing many students and parents to take on debt to pay for college, student loan refinancing has emerged as an option for borrowers to reduce their interest rates (depending on their credit score) and save money on repayment.

Find out why you should consider refinancing your student loans, and learn about SoFi, one of the best-known student loan refinancing companies.

We’ve written before about how student loans, unlike other forms of debt, can’t be discharged in bankruptcy–which is why it’s so important to be careful about how much you borrow.

Bankruptcy law says that, without proving “undue hardship,” a borrower can’t discharge a loan made for an “educational benefit.”

Recently, however, bankruptcy courts have started ruling in favor of some student loan borrowers and have allowed them to discharge their debt, according to The Wall Street Journal.