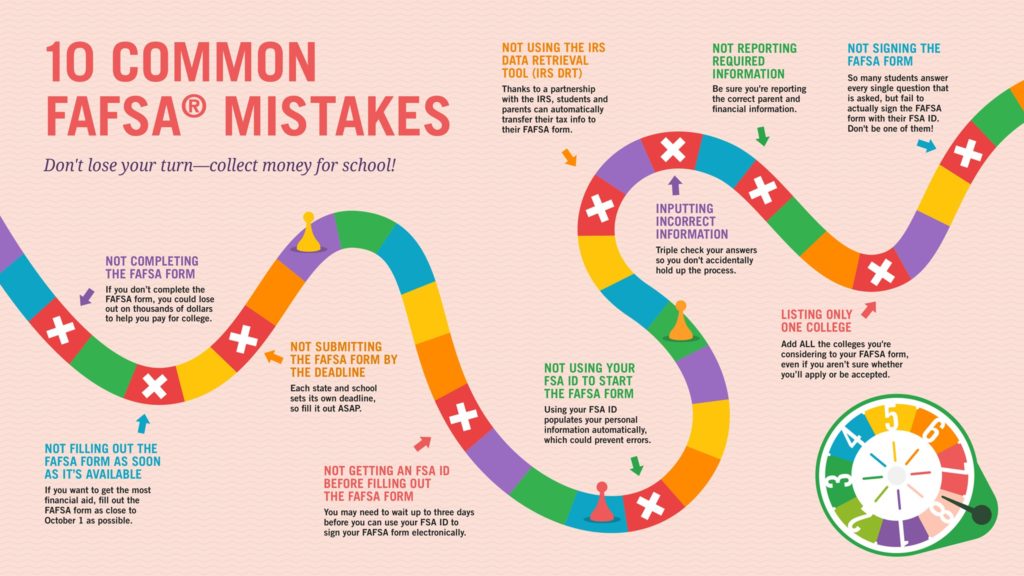

Now that the FAFSA is available in October, it’s important to make sure you’re filling it out as early as possible.

But filling it out correctly is even more important. If you make a mistake on your FAFSA, you could miss out on financial aid.

Check out the top 10 common FAFSA mistakes from the Federal Office of Student Aid to make sure you don’t miss out on free money for college.

We write often about the necessity of making college more affordable in order to minimize student debt. One of the best ways to reduce your college costs is through private scholarships. They can be time-consuming to apply for, but winning free money for college is definitely worth it. With scholarships, you’ll have to take out less in […]

Your student loan debt can affect your credit, which affects whether you’ll be able to buy a car, house or take out a loan in the future.

But a new study shows nearly half of all student loan borrowers don’t know that, according to CNBC.

Before taking out student loans, it’s important to educate yourself about the types of student loans and understand how interest and repayment work so that you can put yourself in a good position to repay them in the future.

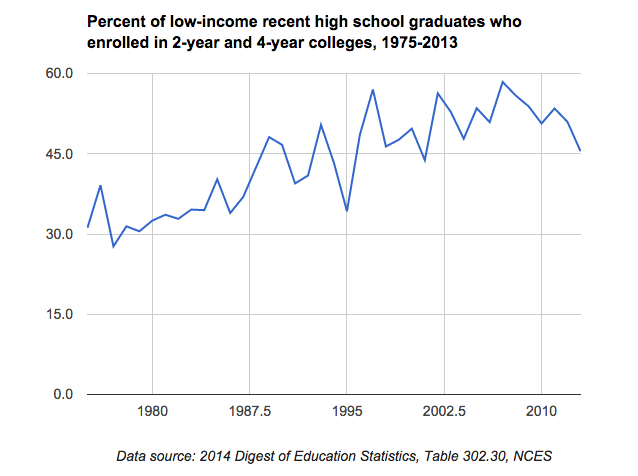

Not surprisingly, the rising cost of college is a big deterrent for students from low-income families to attend college, according to a new report from Urban Institute. Many low-income students don’t have the same access to information about college and financial aid programs from school counselors as higher-income students do, so a large portion of […]

One of the main tenants of Roman Catholicism is to help the poor, but a new study finds Catholic colleges and universities in the U.S. are doing a poor job. The New America Foundation found that five of the 10 most expensive private universities for low-income students, and 10 of the top 28, are Catholic. […]

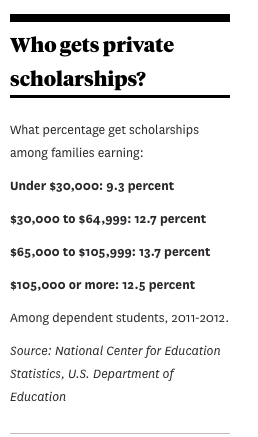

Scholarships and grants are supposed to help students afford college when they may not otherwise be able to.

But a new report finds that most private scholarships, such as those through Rotary Clubs, or other organizations, are going to more wealthy students than poor ones.

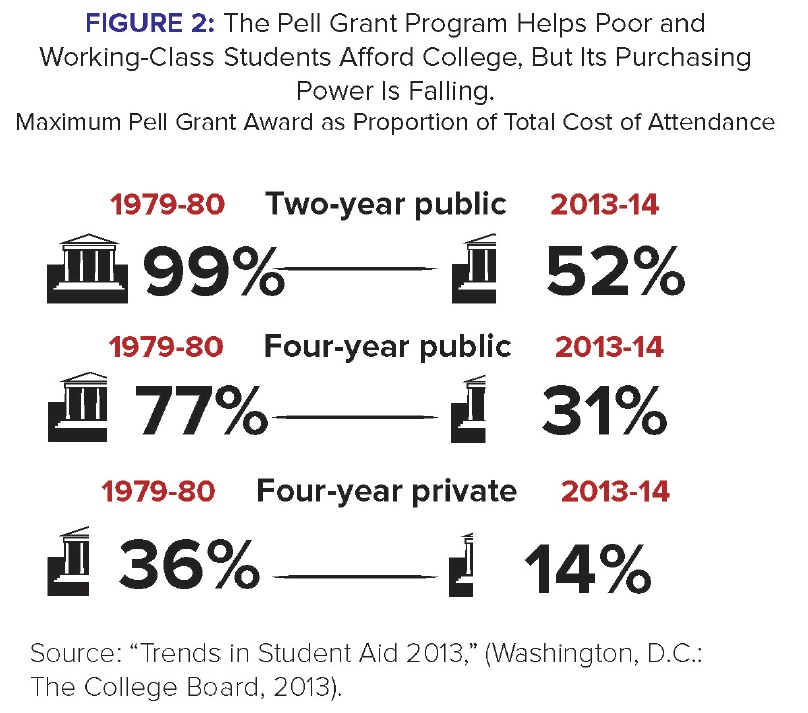

The Federal Pell Grant program was established to help make it possible for low-income students who may have not otherwise been able to afford a college education to do so. Unlike loans, the grant does not have to be repaid, which helps reduce the burden for students who receive the grant.

As college costs have risen, the maximum federal Pell Grant has risen as well–but not nearly enough to cover the huge increase, Inside Higher Education reports.

According to a new report from the Education Trust, New America Foundation, and Young Invincibles, the Pell Grant program is failing to keep up in providing low-income students with access to a college education.

With college costs reaching record levels and still rising, the idea of free college might sound like a pipe dream. Some colleges offer free tuition to the very top students, but these scholarships are extremely competitive. And even with financial aid, most students usually end up paying large amounts for college and taking out student loans. […]

Applying for scholarships, grants and other forms of financial aid to help pay for college can be overwhelming for many students and families. And with the cost of college rising rapidly, there’s no shortage of students applying. The internet has made this a lot easier, but not all financial aid websites are created equal. Tess Clarke, a guidance […]

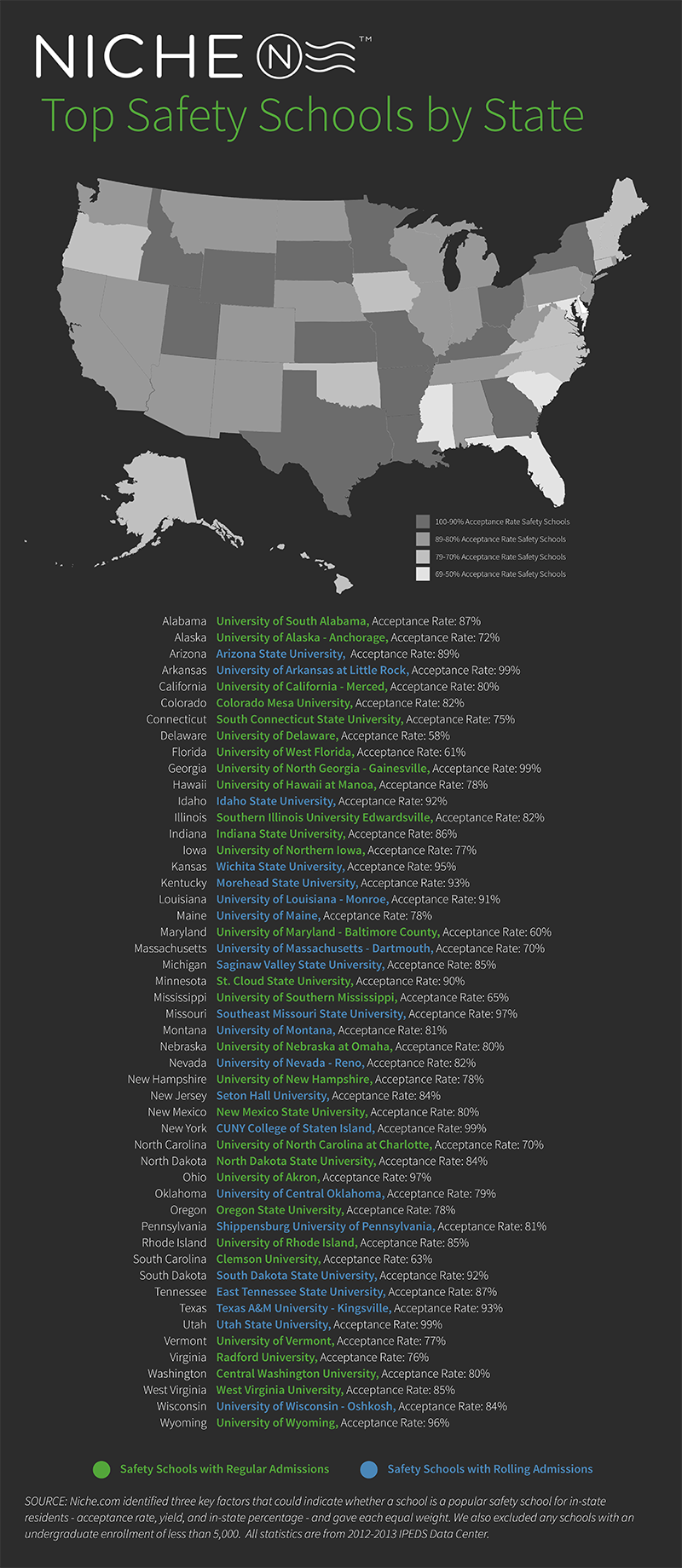

‘Safety schools,’ or colleges considered back-ups to students’ top choices, get a bad rap.

But as many students have found, attending a college that isn’t your first choice can be a great way to save money and avoid student loan debt.