For recent college graduates, paying student loans can be a struggle.

But what if you could get yours paid for you just for moving to a certain city?

Niagara Falls, NY is trying to attract young residents by doing just that. The city will pay off $7,000 of a borrower’s student loans if they live in a designated area of the city for 2 years.

As we’ve explained, defaulting on your student loans has several consequences and could severely damage your credit score.

Of course, it’s best to avoid default by getting on the right student loan repayment plan for your situation and paying your loans on time. But if you’ve already defaulted on your loans, there is a way out.

This helpful video from Centsible Student explains what to do if you’ve defaulted on your loans and what options you have, including repayment plans and student loan consolidation.

We’ve written a lot about the great, affordable colleges in our home state of New York.

And beginning this year, prospective college students and graduates may have another reason to consider making a move to the Empire State: free student loan payments for two years.

With the national student debt topping $1 trillion, more students than ever are defaulting on their student loans.

The average student loan default rate is currently at 9.1%–that’s almost 1 in 10 borrowers.

If you have high student debt, you may be thinking, what’s the worst that can happen if you don’t pay it back?

A lot of terrible things, actually. From a severely low credit score to having your wages garnished, the consequences of defaulting on your student loans are dire.

Student loan repayment can be extremely confusing for new graduates and their parents. With so many different plans and options, it can be difficult to figure out which one is best for you.

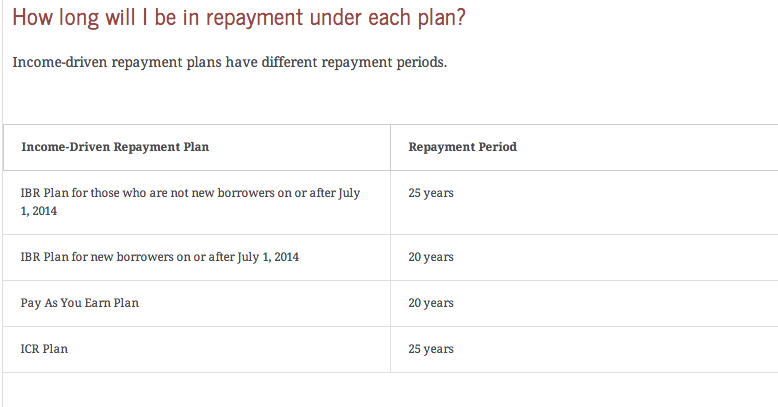

US News recently published a helpful breakdown of the four student loan repayment plans that are income-driven, meaning that your payments are dependent on how much money you make.

When we say we are financial aid and student loan repayment consultants, many people assume we work for a college financial aid office, bank, or other outside organization.

But our work is completely independent. As student loan repayment consultants, we work one-on-one with student loan borrowers to set up a repayment schedule that allows them to manage their debt.

Student debt remains an enormous societal and economic problem, with the average college graduate leaving school with $29,400 in loans, according to College Access and Success. It would be one thing if these graduates were entering an economy with many high-paying jobs available, but that simply isn’t the case, Charles Stevens writes in a fantastic […]

It’s official: the class of 2014 is the most indebted college class ever.

According to an analysis by Mark Kantrowitz published in the Wall Street Journal, the average 2014 college graduate has $33,000 in student loans, the most by any previous class.

Just a year ago, we were talking about how the class of 2013 was the most indebted class ever, but, as has been the case for the past 20 years, the record has been broken by this year’s class.

Sen. Elizabeth Warren (D-MA) says student loan interest rates are ‘crushing’ former students, and something needs to be done. She introduced a plan in March that would let student loan borrowers refinance their loans at lower interest rates. And last week, she filed the bill with the support of 27 co-sponsors. Plan would let borrowers refinance […]

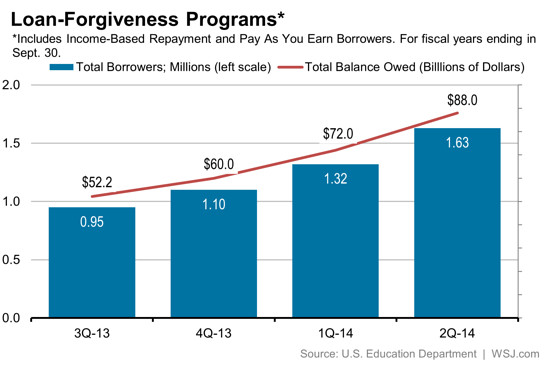

President Obama unveiled the “Pay As You Earn” program in 2011 as a way to provide relief for student loan borrowers struggling to repay their loans. For student loan borrowers with low incomes, especially those in the public sector, the income-based repayment plan helps them manage their monthly payments even without a high-paying job.

The plan capped borrowers’ payments at 10% of their discretionary income per year. After 10 years, for the unpaid balances for those working in the public sector or for nonprofits would be forgiven, while private-sector workers’ debts would be wiped after a 20-year payment period.

But the program has had an unintended consequence: the government is taking on enormous debt, while colleges continue to raise tuition, having no incentive to lower costs when the government is footing the bill.