Your student loan debt can affect your credit, which affects whether you’ll be able to buy a car, house or take out a loan in the future.

But a new study shows nearly half of all student loan borrowers don’t know that, according to CNBC.

Before taking out student loans, it’s important to educate yourself about the types of student loans and understand how interest and repayment work so that you can put yourself in a good position to repay them in the future.

With the price of college continuing to rise, some students, particularly those from low-income families, have found themselves struggling to make ends meet. That’s why some colleges in Texas have taken a step to help, by setting up food pantries for students to pick up free groceries, according to The Texas Tribune. There’s a stereotype that most college […]

With college costs higher than ever before, and families taking on more debt to pay for college, some students have sought alternative routes to finance their education.

Some students are now using income-share agreements, or ISAs, to help pay for college. With an ISA, students get money from investors and they agree to pay a percentage of their future income to those investors over a set period of time.

Students in the U.S. pay more for college than in any other country. It’s no secret that the cost of college has risen astronomically and continues to increase each year.

But why is this the case? And what can be done to prevent costs from rising even further?

In a recent podcast from the University of Pennsylvania’s Knowledge@Wharton High School, Wharton management professor Peter Cappelli and PricewaterhouseCoopers Partner Michael Deniszczuk discuss why costs have risen, how financial aid can affect the cost of college and how student loans have affected borrowers and the economy as a whole.

We all know college is expensive, but there are also many hidden costs that can drive up the price even more. In a video for MONEY, Lynnette Khalfani-Cox of The Money Coach explains the hidden costs of college–and what you can do to reduce them. Hidden college costs can add up Khalfani-Cox notes that hidden […]

There are many factors that determine financial aid eligibility, and it can be difficult to know how much aid you’ll get before you apply.

With college being such a large investment, it’s important to do research and understand how financial aid is determined before applying to colleges in order to maximize your financial aid package.

In a recent segment on Time Money, Lynnette Khalfani-Cox, author of College Secrets: How to Save Money, Cut College Costs and Graduate Debt Free, explains how to maximize your financial aid, the difference between merit and need-based aid, and why you should fill out the FAFSA even if you don’t think you’ll qualify for aid.

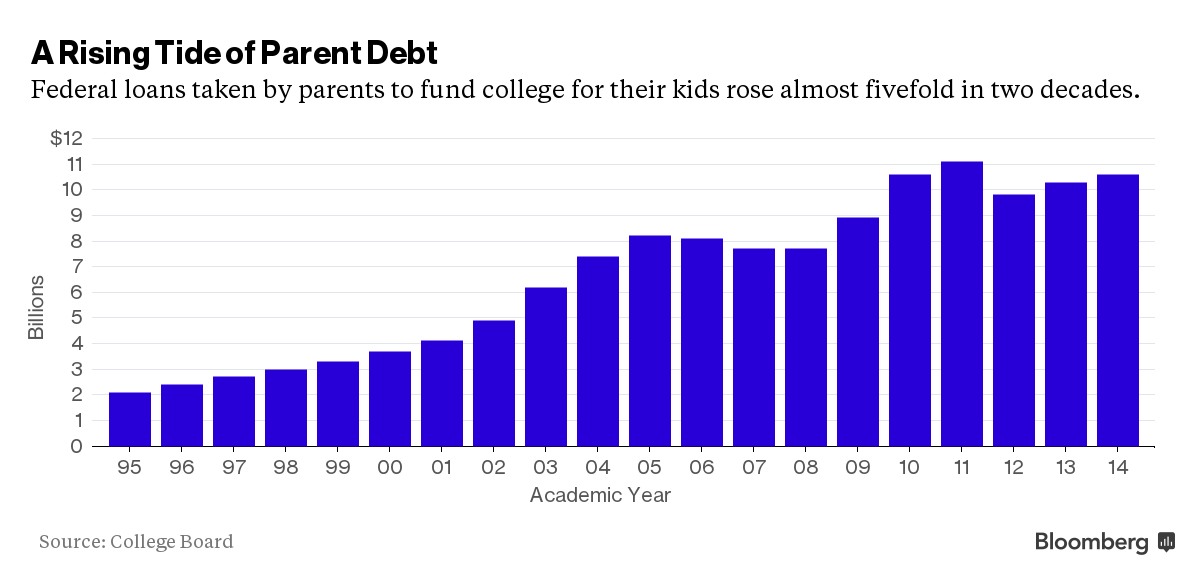

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

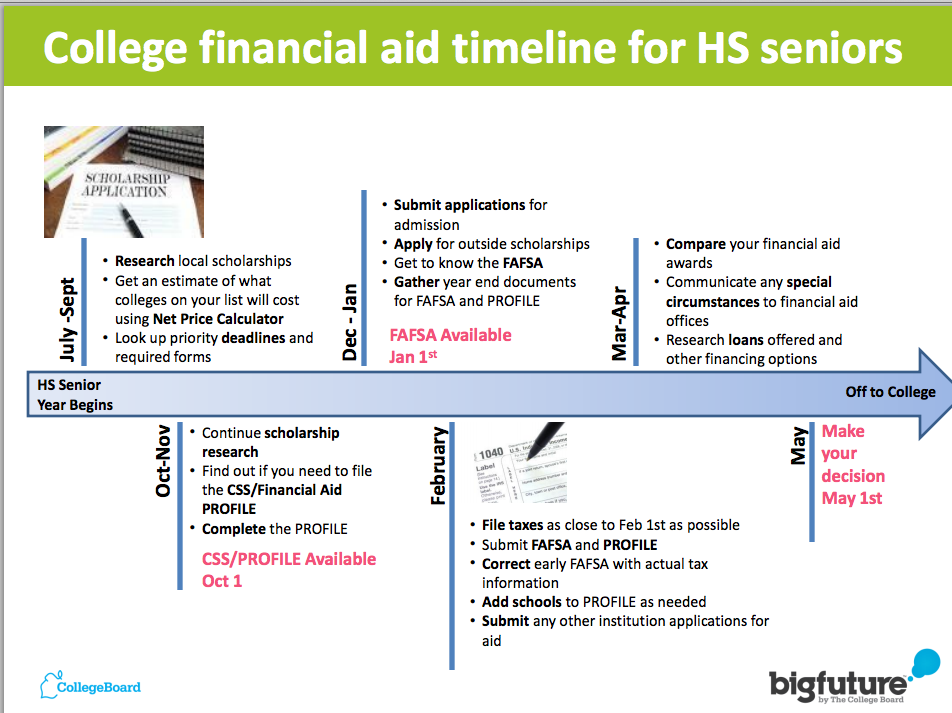

Many college-bound students and parents ask us what they should be doing throughout the year to get ready for applying for college and financial aid.

This handy timeline from The College Board shows exactly what steps students and families should be taking from the summer before senior year to May 1 of senior year, the deadline for students to decide whether to attend most colleges.

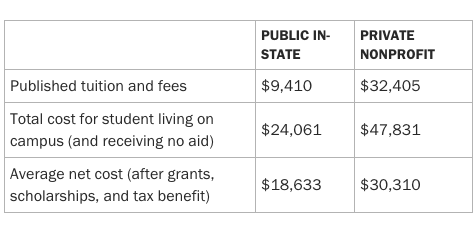

Once again, college tuition rose faster than inflation this year, the College Board reports.

Average college tuition and fees rose about 3% from last year, even though the government reports there has been basically no inflation in the rest of the economy over the past 12 months, according to Money.

While it’s no secret that college tuition, room and board, and fees have risen in recent years, many people don’t realize the cost of textbooks has also gone up dramatically–1,041 percent since 1977, in fact. This can add significantly to a family’s financial burden when paying for college. While there are ways to save on […]