The second post in our student loan refinancing companies series focuses on Credible, a student loan refinancing marketplace that gives you access to multiple lenders with just one application.

Credible doesn’t do any lending itself, but rather aggregates personalized offers from different lenders, including banks and online companies. This allows you to apply for refinancing with multiple lenders all in one place.

With private student loan interest rates on the rise, and the high cost of college forcing many students and parents to take on debt to pay for college, student loan refinancing has emerged as an option for borrowers to reduce their interest rates (depending on their credit score) and save money on repayment.

Find out why you should consider refinancing your student loans, and learn about SoFi, one of the best-known student loan refinancing companies.

Student loan debt isn’t just a problem for millennials. It’s following baby boomers into retirement as well.

The government has collected about $1.1 billion from Social Security recipients of all ages to go toward unpaid student loans since 2001, including $171 million in 2015, the Government Accountability Office said in December.

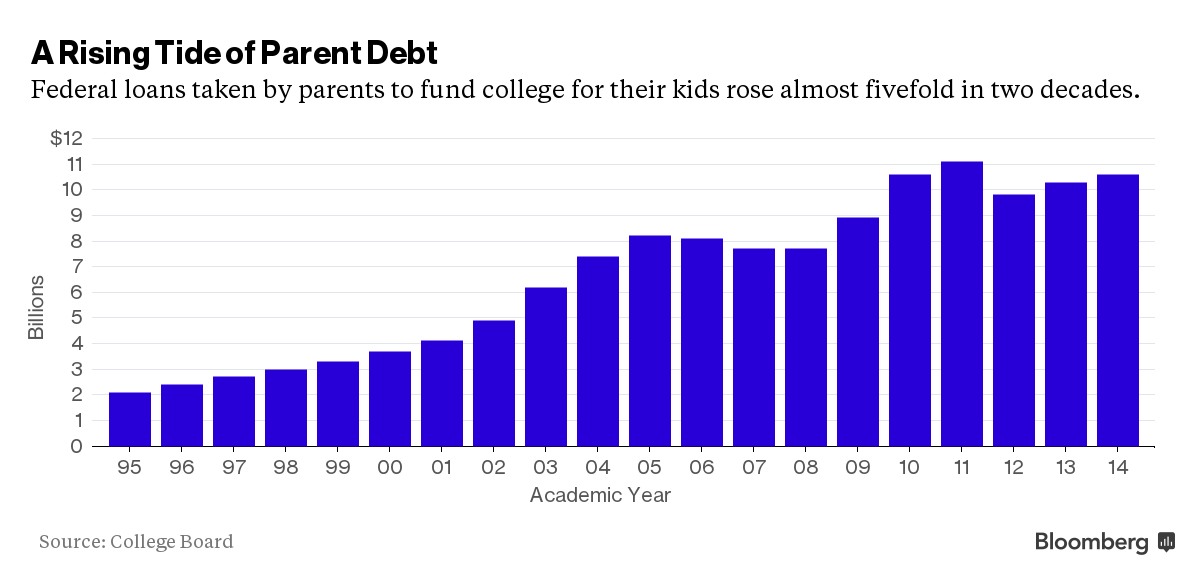

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

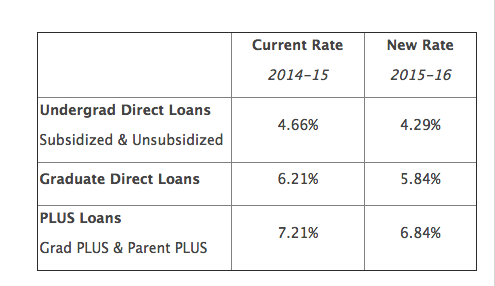

While college costs continue to rise, there’s some good news for students who will be enrolled in college this fall: lower student loan interest rates.

Interest rates on federal student loans for the 2015-16 school year will drop by more than one-third of a percentage point, according to Inside Higher Ed.

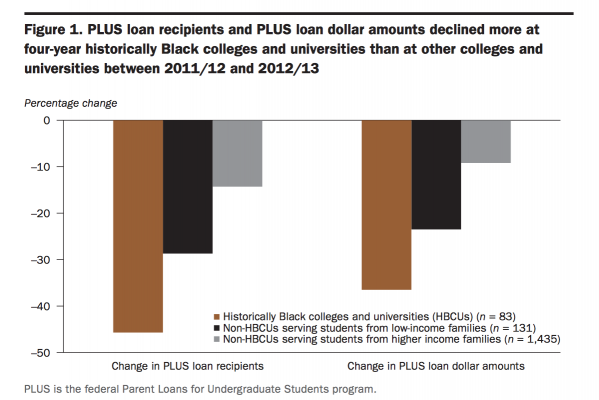

A few years ago, the government reformed its Parent PLUS loan program and tightened credit standards for issuing loans to parents to help pay for college.

While this reform may have reduced predatory lending, it may have had an unintended negative consequence as well: reducing the number of black students in college, according to a new report from Hechinger Report.

The good news? The government has finally come to an agreement on student loan interest rates and agreed to lower rates through the 2015 academic year.

The bad news?After 2015, rates would likely climb higher than they were this past spring.