After college, it can be very stressful for young adults to figure out how to best allocate their money. One of the most common questions we receive is how quickly borrowers should pay off their student loans.

After graduation, young adults are often faced with a host of new responsibilities and expenses: rent, utilities, car payments, and of course, student loans. While they’re trying to pay their bills on an often-meager entry-level salary, they’re also being told to save for retirement and put aside money for emergencies. What should you do–pay off your student loans as quickly as possible, or make lower payments and put the rest toward savings, investments, or other expenses?

A majority of the Class of 2013 graduated with student loans. In the video above, three new graduates talk to CBSNews.com how their loans are influencing their plans for the future.

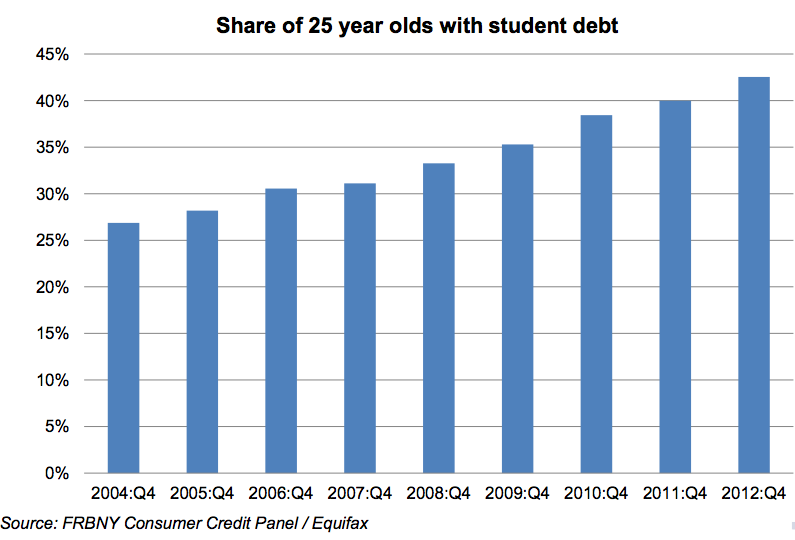

Are you falling behind on your student loan payments? Turns out, you’re not alone. According to a report released yesterday from the New York Federal Reserve, nearly one third of student loan borrowers in repayment are delinquent on their debt. And this number is on the rise–total student loan balances almost tripled between 2004 and 2012 […]