President Obama unveiled the “Pay As You Earn” program in 2011 as a way to provide relief for student loan borrowers struggling to repay their loans. For student loan borrowers with low incomes, especially those in the public sector, the income-based repayment plan helps them manage their monthly payments even without a high-paying job.

The plan capped borrowers’ payments at 10% of their discretionary income per year. After 10 years, for the unpaid balances for those working in the public sector or for nonprofits would be forgiven, while private-sector workers’ debts would be wiped after a 20-year payment period.

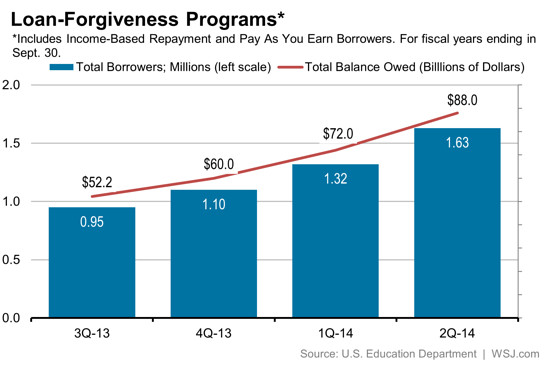

But the program has had an unintended consequence: the government is taking on enormous debt, while colleges continue to raise tuition, having no incentive to lower costs when the government is footing the bill.

What is student loan consolidation and how does it work?

We love this video from StudentLoanConsolidator.com, which explains the process in a unique way–by using Play-Doh to represent student loan consolidation.

For college graduates and adults struggling with student loan repayment, the holiday season can be difficult. So many gifts to give, so little money in the bank account.

But a new service from Tuition.io lets family and friends ease the burden of student loan borrowers during the holidays.

In a recent Guardian article, millennials were asked what they wish their parents had taught them about choosing a college, student loans, and managing their finances. Millennials regret taking on student loan debt Many millennials expressed regret that they had spent so much on their college degree and wished they had looked into less expensive […]

After graduating college, many former students have difficulty finding jobs that allow them to afford their monthly student loan payments.

If you graduate into a low-paying field, you may find yourself barely scraping by–even before you pay your student loans. The lowest-paying major for 2013, Child and Family Studies, has an average starting salary of just $29,300.

Houghton College knows the economy is tough, and it can take new graduates several years to make enough money to pay back their loans, especially in smaller cities, job markets, and careers.

That’s why the small liberal arts college in Houghton, NY has decided to launch an innovative new student loan repayment plan for graduates.

How do I find out how much I owe in student loans? How do I consolidate my loans? Can I lower my student loan interest rate?

This video featuring Money Magazine reporter Carolyn Bigda answers those questions and more. Watch to find out when to start repaying your student loans, what repayment options you have, and how to set up a student loan repayment schedule.

With outstanding student debt now topping $1.2 trillion, it’s extremely important for students to understand their repayment options and take advantage of relief programs to avoid defaulting on their student loans and hurting their credit. But according to ThinkProgress, students aren’t taking advantage of these programs. While one in eight student debtholders is in default, just three percent are enrolled in the income-based plans offered by the […]

When you have multiple loans from different lenders, it can be difficult to keep track of all of your monthly payments and due dates. Consolidation is an option, but it’s not right for everyone.

A new service called Tuition.io makes it easier to manage your student loan repayment and help you plan how much to spend each month. And since the service is free, you have nothing to lose–which means you can put even more money toward your loans.

If you recently graduated college, remember that your grace period doesn’t last forever. Come fall, 2013 college graduates will start receiving student loan bills from their lenders.

The Buffalo News offers some great tips on paying back your student loans and outlines the different types of repayment programs.

With the cost of college skyrocketing over the past 30 years, taking out student loans has become a necessary evil for many students to attend college. The problem is, many borrowers don’t fully understand the terms of the loans they are taking out or what repayment is really like–until graduation hits and they’re faced with an expensive student loan bill every month.

In this insightful video from The Field, real college students share their thoughts about their student debt, why they took out student loans, and how they plan on repaying their debt in the future.