College-bound students will be receiving their financial aid packages within the next couple of months — and many of them will come with student loans.

But many students — even those already attending college — don’t really understand how student loans work. That’s despite nearly 70% of students graduating with student debt.

Student debt continues to be a major issue for college students and graduates in the U.S.

U.S. total student debt is now over $1.4 trillion, and the average debt for a college graduate in 2016 was $37,000. And 44 million Americans now have student debt to their name.

The video below gives tips on how student loan borrowers can avoid falling behind on their payments. It also explains why millennials should be saving for retirement even if they have student debt.

With the national student debt now at $1.3 trillion, and thousands of borrowers in default, some borrowers are going to great lengths to avoid paying back their debt–including moving to a whole other country. Hiding from student debt collectors abroad An interesting new article from VICE takes a look at the many Americans who have moved […]

Wondering what to get the millennial in your life this Christmas?

Consider giving them something they probably need: a gift toward their student loan payments.

According to MarketWatch, a new site called LoanGifting allows family, friends and others to make payments directly toward someone’s student loans.

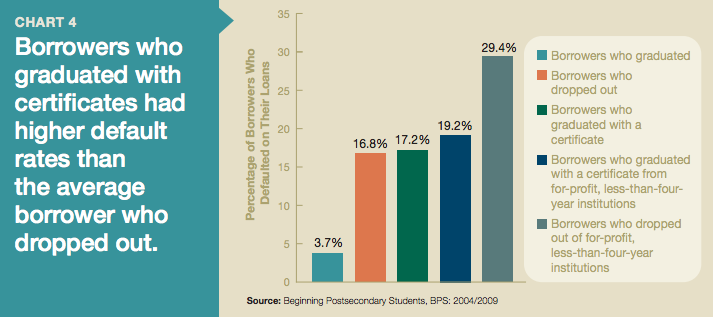

Dropping out of a college, in general, makes borrowers more likely to default on their student loans, because it makes it more difficult for them to find a good-paying job and afford their student loan payments.

But certain college dropouts have it worse than others–those who dropped out of a for-profit, less-than-four-year college.

As we’ve explained, defaulting on your student loans has several consequences and could severely damage your credit score.

Of course, it’s best to avoid default by getting on the right student loan repayment plan for your situation and paying your loans on time. But if you’ve already defaulted on your loans, there is a way out.

This helpful video from Centsible Student explains what to do if you’ve defaulted on your loans and what options you have, including repayment plans and student loan consolidation.

We’ve written a lot about the great, affordable colleges in our home state of New York.

And beginning this year, prospective college students and graduates may have another reason to consider making a move to the Empire State: free student loan payments for two years.

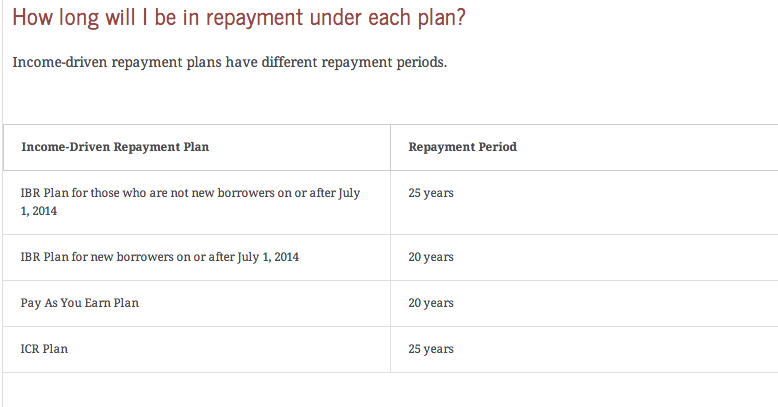

Student loan repayment can be extremely confusing for new graduates and their parents. With so many different plans and options, it can be difficult to figure out which one is best for you.

US News recently published a helpful breakdown of the four student loan repayment plans that are income-driven, meaning that your payments are dependent on how much money you make.

What’s keeping millennials up at night? It’s not just Netflix–it’s student debt.

NPR’s Morning Edition recently asked young adults, members of the millennial generation, what their biggest concerns were.

The results were telling: almost two-thirds responded that college debt was their biggest worry.

In a press release issued February 25, student loan servicer Sallie Mae announced that it will separate into two distinct companies—Navient and Sallie Mae—in fall 2014.

If you have a loan through Sallie Mae, there may be some changes, but the federal government assures borrowers the changes will be minimal, and no changes will occur until later this year.

Here are the 6 things you need to know if you have a student loan serviced by Sallie Mae.