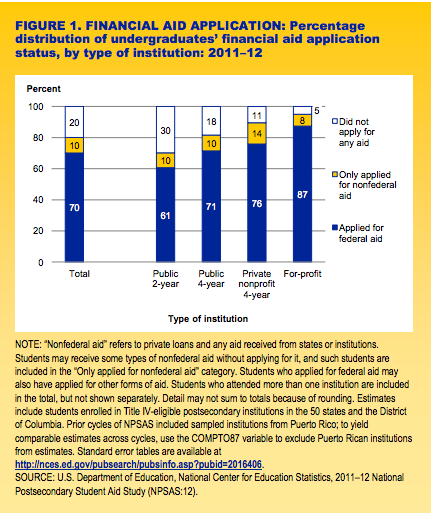

We write often about the importance of applying for financial aid, even if you don’t think you’re qualified to receive it.

But a new study from the National Center for Education Statistics (NCES) found that 1 in 5 students don’t apply for financial aid at all.

Your student loan debt can affect your credit, which affects whether you’ll be able to buy a car, house or take out a loan in the future.

But a new study shows nearly half of all student loan borrowers don’t know that, according to CNBC.

Before taking out student loans, it’s important to educate yourself about the types of student loans and understand how interest and repayment work so that you can put yourself in a good position to repay them in the future.

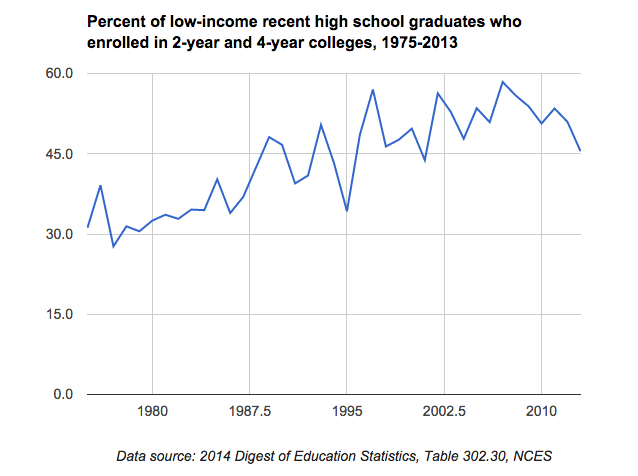

Not surprisingly, the rising cost of college is a big deterrent for students from low-income families to attend college, according to a new report from Urban Institute. Many low-income students don’t have the same access to information about college and financial aid programs from school counselors as higher-income students do, so a large portion of […]

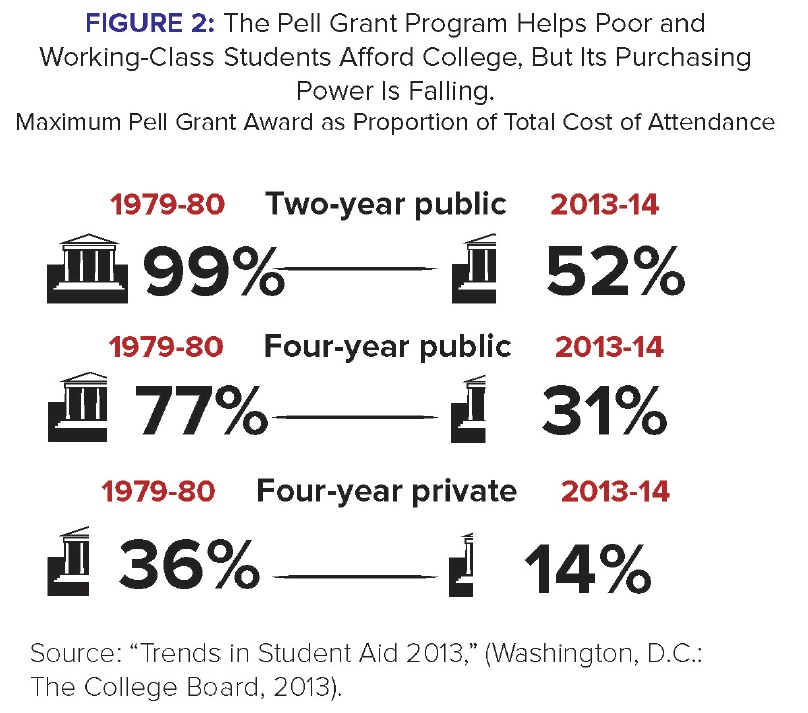

While the government claims to be working to make college more affordable for students, actions speak louder than words.

The House of Representatives voted last week to cut $303 million from the federal Pell Grant program–a program that provides low-income students with grants for college.

The Federal Pell Grant program was established to help make it possible for low-income students who may have not otherwise been able to afford a college education to do so. Unlike loans, the grant does not have to be repaid, which helps reduce the burden for students who receive the grant.

As college costs have risen, the maximum federal Pell Grant has risen as well–but not nearly enough to cover the huge increase, Inside Higher Education reports.

According to a new report from the Education Trust, New America Foundation, and Young Invincibles, the Pell Grant program is failing to keep up in providing low-income students with access to a college education.

Even as college costs rise, millions of students are missing out on the opportunity to get free money for college.

According to an analysis of federal data by Mark Kantrowitz, senior vice president at Edvisors Network, about 2 million students could have qualified for the need-based Federal Pell Grant during the 2011-12 academic year.

Of that group, 1.3 million would have qualified for a full Pell Grant of $5,645 for the 2013-14 academic year. That’s a free $22,580 over 4 years. If these students had instead borrowed loans to cover that amount, they’d have to pay it all back, plus interest.

So why didn’t these student receive this free money for college?

They didn’t file the Free Application for Federal Student Aid (FAFSA).

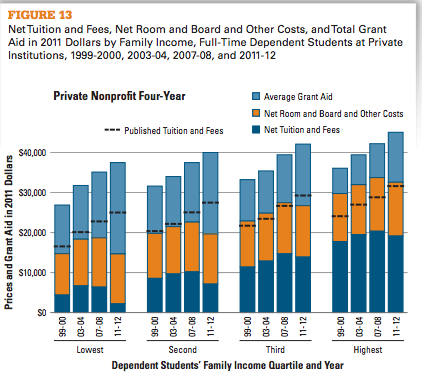

Despite the recent hype over rising college costs, the net price of a private college education has remained the same over the past decade, according to a new study from The College Board published in the New York Times.

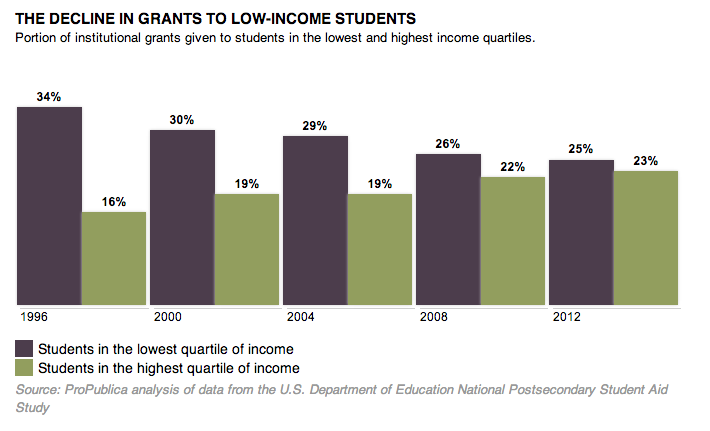

A new investigation from ProPublica has found that public colleges and universities are increasingly giving less financial aid to poor students in favor of wealthier ones. Even through the economic recession, public schools continued to favor high-income students in favor of students who need the money the most. The chart below shows that from 1996 through 2012, […]

In his recent trip to nearby Buffalo, Syracuse, and Binghamton, President Obama revealed his new plan to make college more affordable.

This handy infographic from the White House explains the major reforms and initiatives the President hopes to advance in order to hold colleges accountable for providing a quality education, encourage schools to use technology to cut costs, and make it easier for borrowers to repay their student loans.

In his visit to Western New York today, President Obama unveiled a series of higher education reforms aimed at making college more affordable. A new way of ranking colleges His ideas include creating a new rating system for colleges that would judge schools on measures like tuition, graduation rates, debt and earnings of graduates, and […]