We write often about the necessity of making college more affordable in order to minimize student debt. One of the best ways to reduce your college costs is through private scholarships. They can be time-consuming to apply for, but winning free money for college is definitely worth it. With scholarships, you’ll have to take out less in […]

Your student loan debt can affect your credit, which affects whether you’ll be able to buy a car, house or take out a loan in the future.

But a new study shows nearly half of all student loan borrowers don’t know that, according to CNBC.

Before taking out student loans, it’s important to educate yourself about the types of student loans and understand how interest and repayment work so that you can put yourself in a good position to repay them in the future.

With college costs higher than ever before, and families taking on more debt to pay for college, some students have sought alternative routes to finance their education.

Some students are now using income-share agreements, or ISAs, to help pay for college. With an ISA, students get money from investors and they agree to pay a percentage of their future income to those investors over a set period of time.

We reported earlier this year how students and parents were required to create an FSA ID in order to fill out the Free Application for Federal Student Aid (FAFSA) this year and explained how to do it in this post. But the new FSA ID requirement is causing confusion and problems for parents and students trying to submit […]

There are many factors that determine financial aid eligibility, and it can be difficult to know how much aid you’ll get before you apply.

With college being such a large investment, it’s important to do research and understand how financial aid is determined before applying to colleges in order to maximize your financial aid package.

In a recent segment on Time Money, Lynnette Khalfani-Cox, author of College Secrets: How to Save Money, Cut College Costs and Graduate Debt Free, explains how to maximize your financial aid, the difference between merit and need-based aid, and why you should fill out the FAFSA even if you don’t think you’ll qualify for aid.

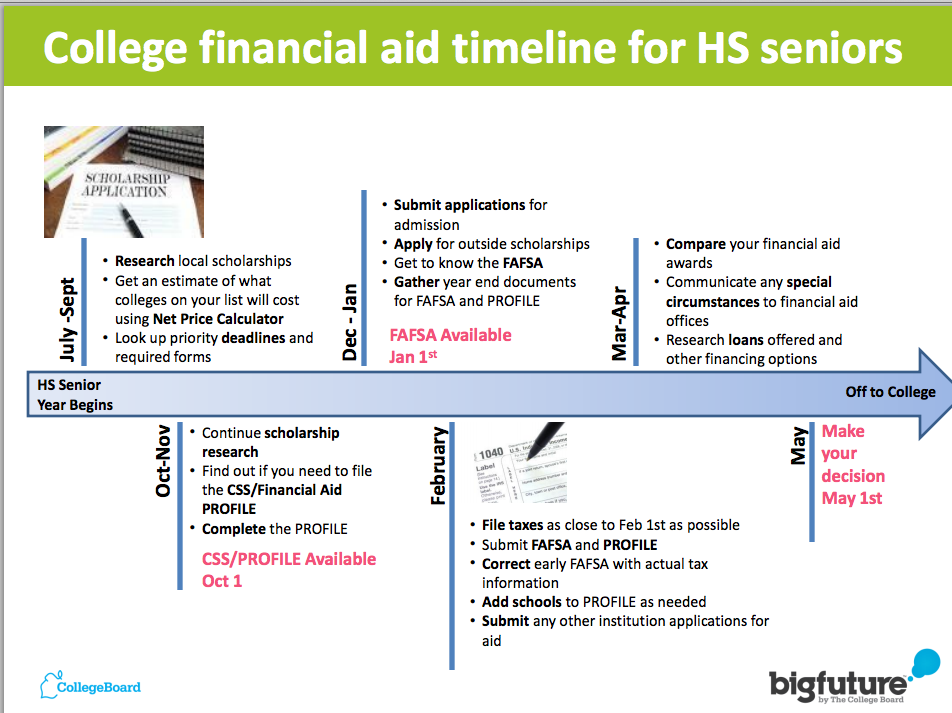

Many college-bound students and parents ask us what they should be doing throughout the year to get ready for applying for college and financial aid.

This handy timeline from The College Board shows exactly what steps students and families should be taking from the summer before senior year to May 1 of senior year, the deadline for students to decide whether to attend most colleges.

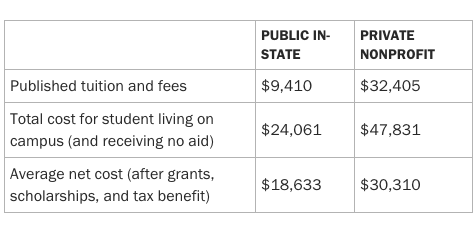

Once again, college tuition rose faster than inflation this year, the College Board reports.

Average college tuition and fees rose about 3% from last year, even though the government reports there has been basically no inflation in the rest of the economy over the past 12 months, according to Money.

The average college graduate now leaves school with $30,000 in student debt, and the national student debt total of $1.3 trillion is rising every day. Many prospective college students don’t realize the huge impact student debt can have on their lives–and how much compound interest can add up over time, resulting in a much larger […]

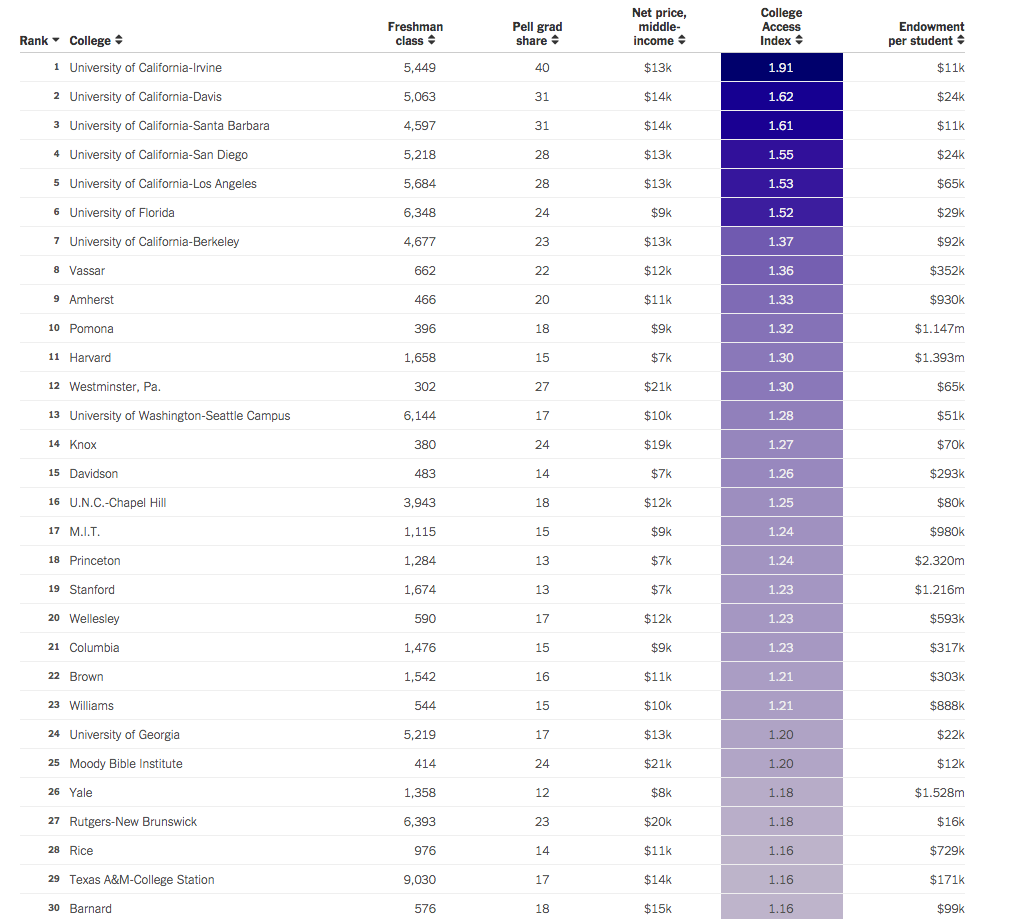

While many colleges offer a great education, there are definitely some that are more accessible to low-income students than others.

For low-income students concerned about the cost of college, it’s important to know which colleges offer generous financial aid and programs that will help them succeed and graduate without taking on enormous student debt.

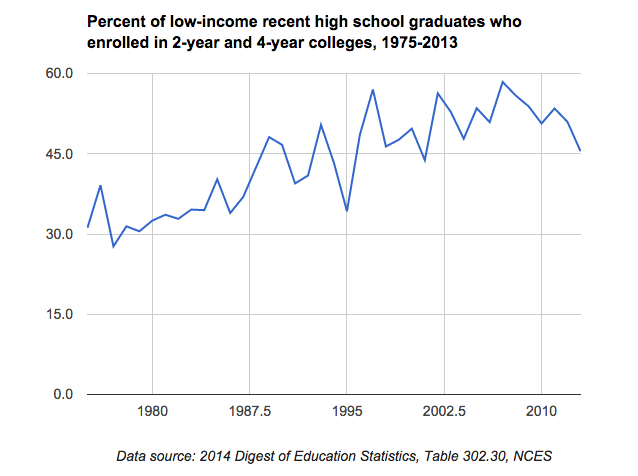

Not surprisingly, the rising cost of college is a big deterrent for students from low-income families to attend college, according to a new report from Urban Institute. Many low-income students don’t have the same access to information about college and financial aid programs from school counselors as higher-income students do, so a large portion of […]