Now that the FAFSA is available in October, it’s important to make sure you’re filling it out as early as possible.

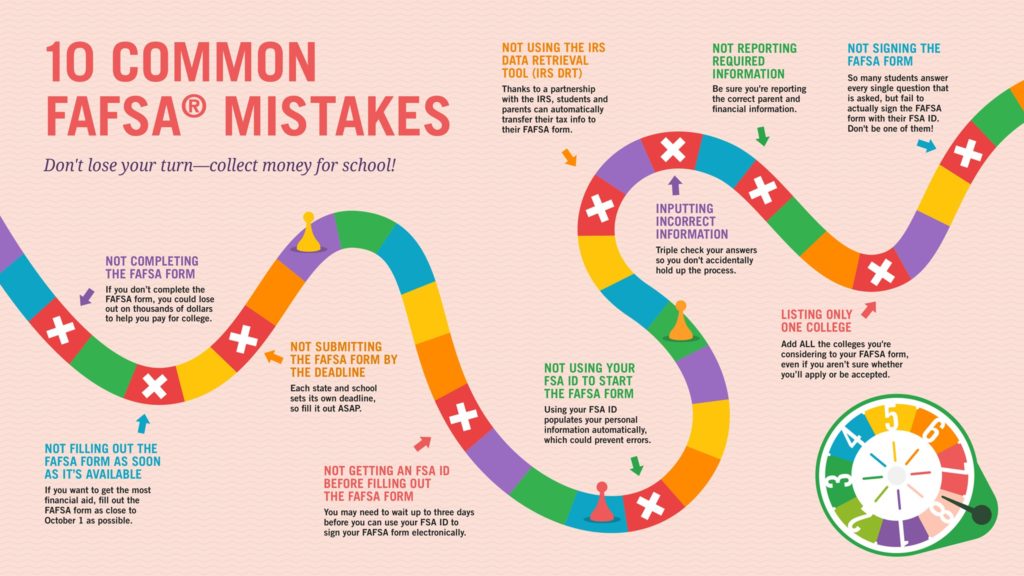

But filling it out correctly is even more important. If you make a mistake on your FAFSA, you could miss out on financial aid.

Check out the top 10 common FAFSA mistakes from the Federal Office of Student Aid to make sure you don’t miss out on free money for college.

While the general trend is for college costs to rise each year, some private colleges have decided to buck the trend by significantly lowering tuition costs, according to a recent CBSNews article.

Two dozen private colleges have cut tuition since 2016, according to the National Association of Independent Colleges and Universities.

The Free Application for Federal Student Aid (FAFSA) is now available for the 2019-20 school year.

All students attending college in fall 2019 and/or spring 2020 should use this application to apply for financial aid. Watch this video for step-by-step instructions on how to complete the form.

Few students can afford the high price of college without financial aid. So for prospective college students and families, it’s crucial to know which schools award the most aid before applying to college.

The Princeton Review recently ranked colleges based on students’ ratings of overall satisfaction with their financial aid packages at the 384 best colleges in the U.S. According to their analysis, these are the best colleges for financial aid in 2018:

Most people understand that student loans come with interest — which can add several thousand dollars onto the life of the loan, especially if you extend out your payments.

But many people don’t realize that federal student loans also come with origination fees, much like mortgages or car loans, which can add significantly to student debt totals.

It’s that time of the year: time for college-bound students and their parents should fill out the Free Application for Financial Aid (FAFSA).

Students and parents should complete the FAFSA ASAP for priority financial aid consideration.

Even if you’ve filled out the FAFSA before, there are some big FAFSA changes you need to know about if you haven’t submitted one in the past couple of years.

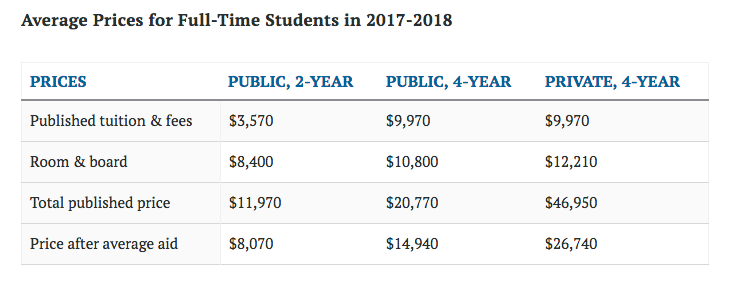

We’ve written in the past how net price — the price you actually pay for college after financial aid, grants and scholarships — is more important than a college’s published price.

Many colleges have high sticker prices, but end up being affordable because they have generous financial aid policies.

Unfortunately, because the rise in financial aid hasn’t kept up with rising costs, the net price of college has risen for the sixth straight year, Money reports.

As of October 1, students can no longer take out federal Perkins Loans to help them pay for college.

The government’s oldest federal student aid program, established in 1957, ended Sept. 30, after Congress failed to extend the program. As a result, up to 500,000 eligible students at 1,500 colleges will no longer be able to take advantage of this financial aid program.

As of October 1, the Free Application for Federal Student Aid (FAFSA) is now available for families and students applying for financial aid for the 2018-19 academic year.

Current high school seniors as well as college freshmen, sophomores and juniors will need to fill out the FAFSA to receive federal financial aid for next year.

There’s been plenty of talk (and controversy) over the Excelsior Scholarship program, which will provide students in New York from families under specific income levels with free tuition at state public colleges.

One new aspect of the new free college initiative that’s been overlooked by many is the Enhanced Tuition Awards Program, which provides up to $6,000 for students who choose to attend private colleges instead of one of the state’s SUNY or CUNY colleges.

But it hasn’t been all smooth-sailing for this program, either. In fact, a majority of the state’s private colleges are choosing not to participate, The Journal News reports.