As college costs have risen, financial aid at most colleges hasn’t kept up, leaving students to make up the difference with loans.

According to Peterson’s, the average college only provides enough scholarships or grants to meet 70% of what low- and moderate-income students need to pay their college bill.

How that January 1 has come and gone, it’s time for college-bound families to start filling out the Free Application for Federal Student Aid (FAFSA).

The video below from Censtible Student clearly explains the basics of the FAFSA, including what you need to file and how to fill it out.

Getting ready to go to college or have a child who is? It’s time to fill out the Free Application for Federal Student Aid (FAFSA).

Many parents and students have misconceptions about what the FAFSA is and who should fill it out. Some families don’t bother because they assume they make too much money to qualify for federal aid.

But confusion about the FAFSA can cost you–you may lose out on financial aid, including grants, scholarships, and student loans.

It might seem unfair, but researchers from Rice University in Houston and the University of Wisconsin have found that martial status plays a significant role in college costs and financial aid. Students from families of divorce pay more According to a NY Times report and a study published in the Journal of Family Issues, college costs fall more […]

How should financial aid be given out? How can we make college more affordable? How can student loans be improved? The NY Times recently explored these questions and more in a Room for Debate column. Simplifying financial aid The higher education professionals involved in the discussion emphasized the need for creative solutions to pay for […]

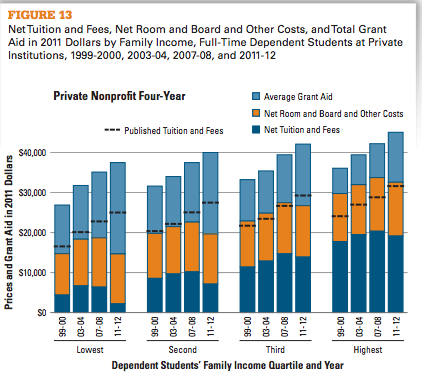

Despite the recent hype over rising college costs, the net price of a private college education has remained the same over the past decade, according to a new study from The College Board published in the New York Times.

This video from Reuters TV offers a year-by-year plan for high school students and their parents to help them prepare for college. It includes some great tips on saving for college and how to get the most financial aid possible.

We often hear about student debt as a problem for recent college graduates in their 20s and 30s. But it’s not just young adults who are struggling to pay back their loans. Their parents are suffering as well.

Americans ages 50-59 owe a combined $112 billion in student loans. That’s triple what they owed in 2005. Why the dramatic increase? Because many parents are taking out additional loans to pay for their children’s education, despite still paying off their own student loan debt.

Inside Higher Education published a great piece on understanding “financial aid speak” from college financial aid offices. To the average parent, it can feel like college financial aid representatives are speaking a whole different language.

Many prospective and current college students don’t realize that their income and assets are taken into account when they apply for financial aid, just like that of their parents. So should students be worried about earning too much money and receiving less financial aid if they have a job?