As the cost of college has risen, the burden of paying for it has fallen on students more than ever.

CNBC reports that college students are saving an average of $7,801, according to the second edition of the Allianz Tuition Insurance College Confidence Index.

That’s up 17% from $6,678 in 2017.

As college has gotten more expensive, more families have made it a priority to save money to put toward their children’s college education.

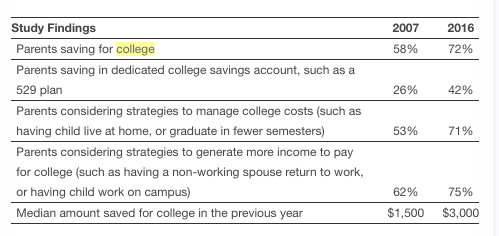

According to Fidelity Investments’ 10th Annual College Savings Indicator Study, as reported by GoodCall, the percentage of parents saving for college is at an all-time high.

People are always telling parents to put away money for their children’s college education, especially with the cost of college rising so quickly over the past two decades.

But it’s not always easy.

Between the mortgage, car payments, and other expenses, many parents find it nearly impossible to save money for college. And most aren’t even sure how much to save, especially when they’re trying to save for retirement at the same time.

With the cost of college rising, many parents are turning to 529 plans to pay for their future children’s college tuition.

These plans allow families to put away money tax-free for future use. Like a 401K or IRA, funds are invested in mutual funds or similar investments.

When your child finally reaches college age, many parents wonder if they should put their entire 529 savings toward their student’s first year of tuition or save some for future years in order to allow the fund to grow even more.

Want to apply to college, but worried about all those application fees adding up? The College Board wants to help you.

If you got a high score on your SAT or PSAT, you may soon be receiving a package that will make it free to apply to 6 colleges of your choice, the New York Times reports. The College Board is sending fee waivers to about 28,000 seniors who scored in the top 15 percent of test takers and whose family is in the bottom quarter of income distribution.

This summer, college students and their parents narrowly avoided a student loan interest rate hike that would have raised interest rates on new subsidized Stafford loans from 3.4 percent to 6.8 percent. The deal set Federal Stafford Loans for undergraduates at 3.85%, Graduate PLUS loans at 5.4%, and Parent PLUS loans at 6.4%.

While college-bound students and their families breathed a collective sigh of relief, the deal came with a catch: student loan interest rates would be tied to the health of the economy. If the economy improves as economists predict, rates would increase in coming years. In fact, rates would likely climb higher than they were this past spring.

For families who have saved for college with a 529 plan, the new deal presents an interesting conundrum. Should you use the funds in your account now to pay for your student’s education or save them for the future, when it might be more expensive to borrow?

We sometimes hear from students and parents asking if college is even worth attending in today’s era of astronomical costs and a still sluggish-economy. For many, college is a great investment that pays off in the long run by giving students opportunities to enter certain career field and make more money over their lifetimes. But for some people, it’s not worth the cost because they choose the wrong school, never finish their degree, or end up paying too much.

Instead of asking whether college is worth it, Washington Monthly argues that students and families should be asking themselves, “What colleges will charge people like me the least and give me the highest chance of graduating with a degree that means something in the marketplace?” So they created a formula to help college students and families figure it out.

Even with today’s high cost of college, it’s still possible to pay for school without taking out student loans. This article offers some great tips and advice for reducing college costs, from taking college classes while you’re still in high school to actively searching for scholarships all through college. Because of her diligence, the author was […]

Believe it or not, private colleges are now offering more financial aid than ever. Of course, with college costs rising, it make sense for financial aid to adjust accordingly. However, it’s not just the amount of grants and scholarships that’s increasing–it’s the percentage of the overall tuition total. According to Time Magazine, in a survey […]

A 529 plan is an investment plan that allows families to put aside money tax-free and use it to pay for educational expenses later. It sounds like a great idea, but it’s not the right choice for every family and could actually reduce your eligibility for financial aid later. Read on to learn about the benefits, drawbacks, and things to consider before investing in a 529 plan.