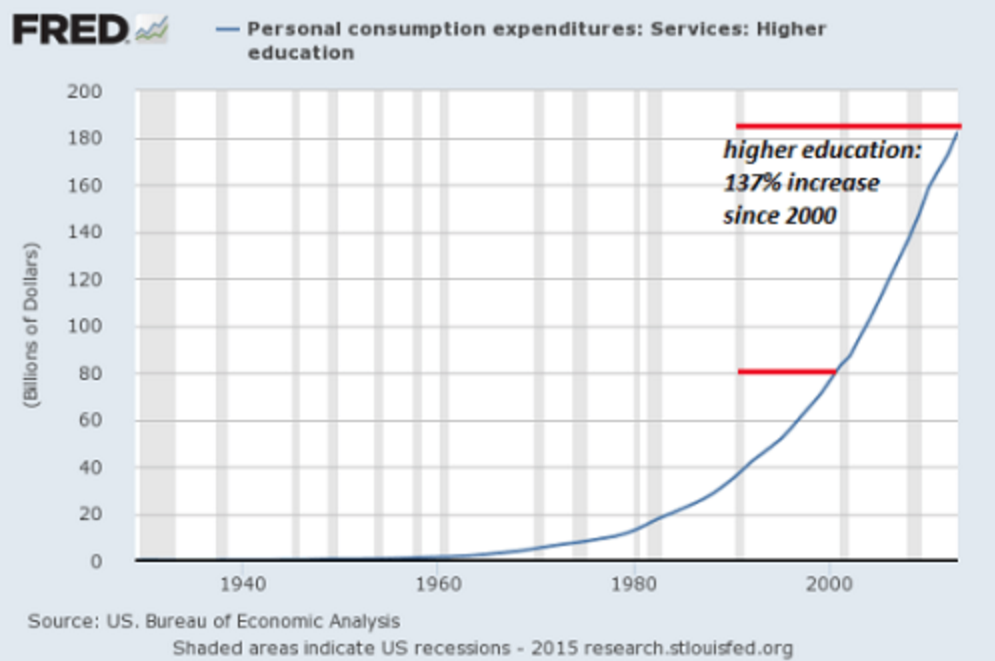

It’s well known that the student loan crisis has gotten out of control and continues to grow every second. According to Business Insider, student debt has skyrocketed from $500 billion in 2006, just 9 years go, to over $1.3 trillion today. Many people in government have proposed student loan forgiveness and other strategies to help reduce […]

Why is college so expensive? Is it worth the investment? VICE News recently aired a segment on the rising cost of college and asked a panel and viewers those questions, among others about the increase in student debt and how different college degrees affect future earnings. Is college worth the cost? The panel included Student Voice’s […]

We write a lot about the country’s rising student loan debt and the fact that it’s already over $1.3 trillion, as well as the effects it’s had on the economy and borrowers’ lives.

But it’s a lot different to actually see it grow by the second. MarketWatch has created a national student loan debt clock to help people visualize just how quickly student loan debt is growing, and it’s pretty sobering to watch.

In fact, by the time you finish reading this post, it will likely have grown by $366,600.

With 70% of college graduates now leaving school with debt and the national student loan debt now at $1.3 trillion and growing, there have been many proposed solutions on how to combat the country’s student loan problem. According to Martin O’Malley, the former governor of Maryland, the federal government must act swiftly to stop the student […]

Most parents look forward to their children graduating from college, as it marks the time in their lives when they can start becoming real adults and taking care of themselves–moving out, finding a full time job, and potentially getting married, having kids, or buying a home.

But a recent study from the University of Arizona, as reported by CNN Money, has found that that’s not the case for more than half of recent college graduates, who report they still depend on their parents for money.

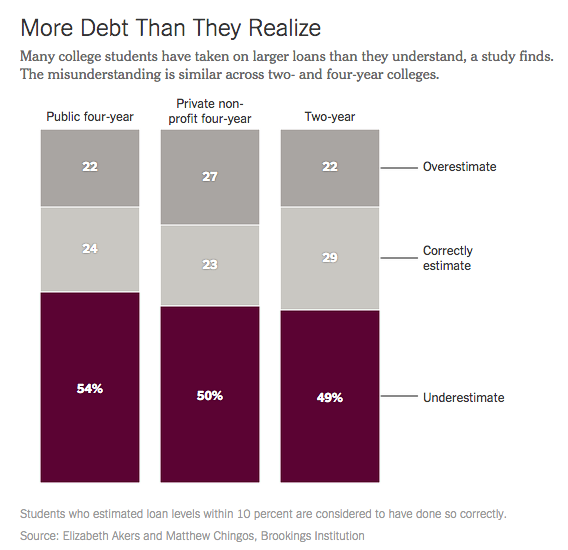

When most students enter college, student debt is a far thing from their minds. They’re more likely to be concerned with classes, making friends, and adjusting to a new place. Since most students enter college as young adults, it’s difficult for many to grasp how student loans work and the consequences of taking them out. But […]

It’s no secret that student debt is a big issue for millions of Americans. We’re constantly hearing scary statistics about the rising amount of student loan debt (currently over $1.2 trillion) and how many borrowers are struggling to repay their loans.

But a recent study, as described in U.S. News & World Report, showed that three types of borrowers are struggling the most and accounting for a large part of the high numbers we hear associated with student debt.

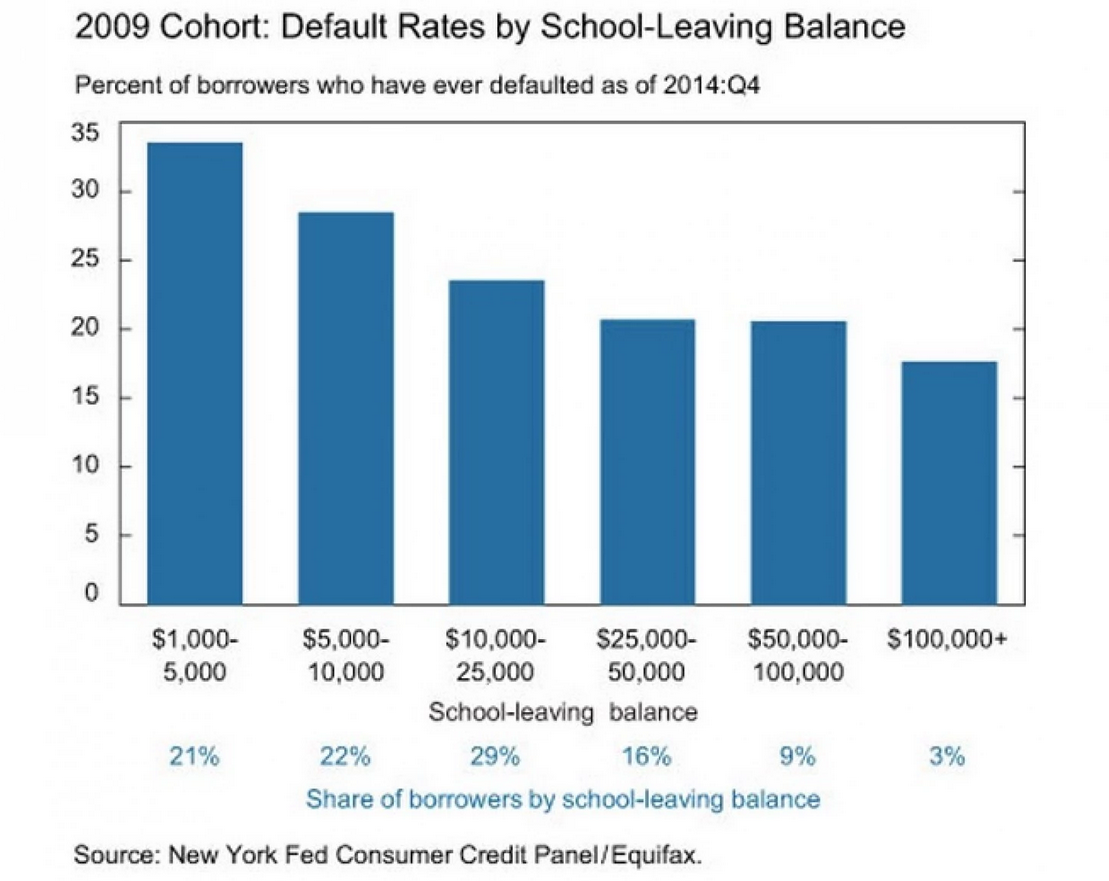

One would assume that graduating with a high level of student debt would put a borrower at greater risk of falling behind on their payments and defaulting on their student loans.

But a new report from the Federal Reserve Bank of New York found the exact opposite to be true.

Over 100 students who attended the now-defunct for-profit Corinthian Colleges system are striking out against their former college and refusing to repay their student loans.

The students are attempting to pressure the government into forgiving their debt, alleging that the colleges didn’t hold up their end of the bargain–by providing a subpar education and not preparing them for a post-graduate career.

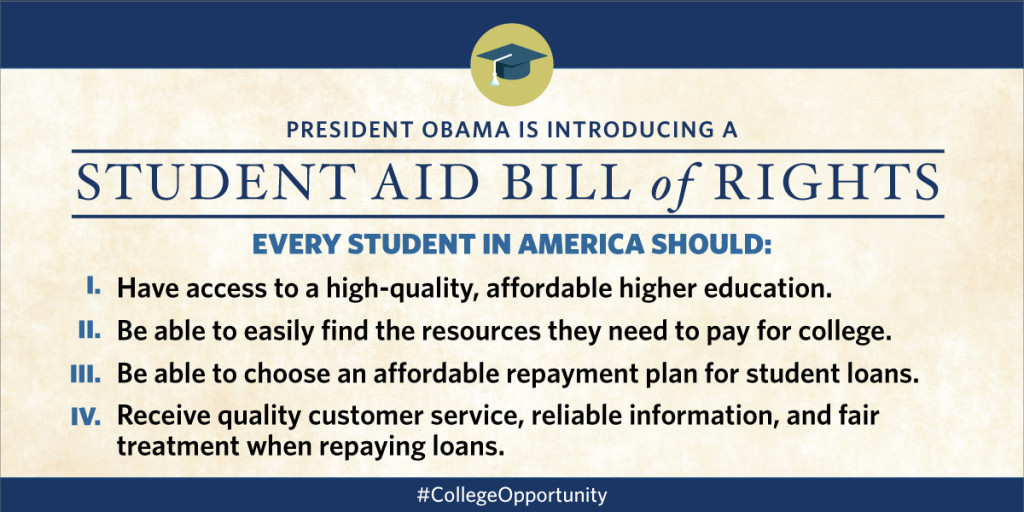

While the White House has introduced recent proposals to lower the cost of college for incoming students, the 40 million Americans struggling with student loan debt haven’t seen much relief.

But President Obama’s new Student Aid Bill of Rights could help change that and make borrowing and repaying federal student loans a less painful process.