With the cost of college rising, many parents are turning to 529 plans to pay for their future children’s college tuition.

These plans allow families to put away money tax-free for future use. Like a 401K or IRA, funds are invested in mutual funds or similar investments.

When your child finally reaches college age, many parents wonder if they should put their entire 529 savings toward their student’s first year of tuition or save some for future years in order to allow the fund to grow even more.

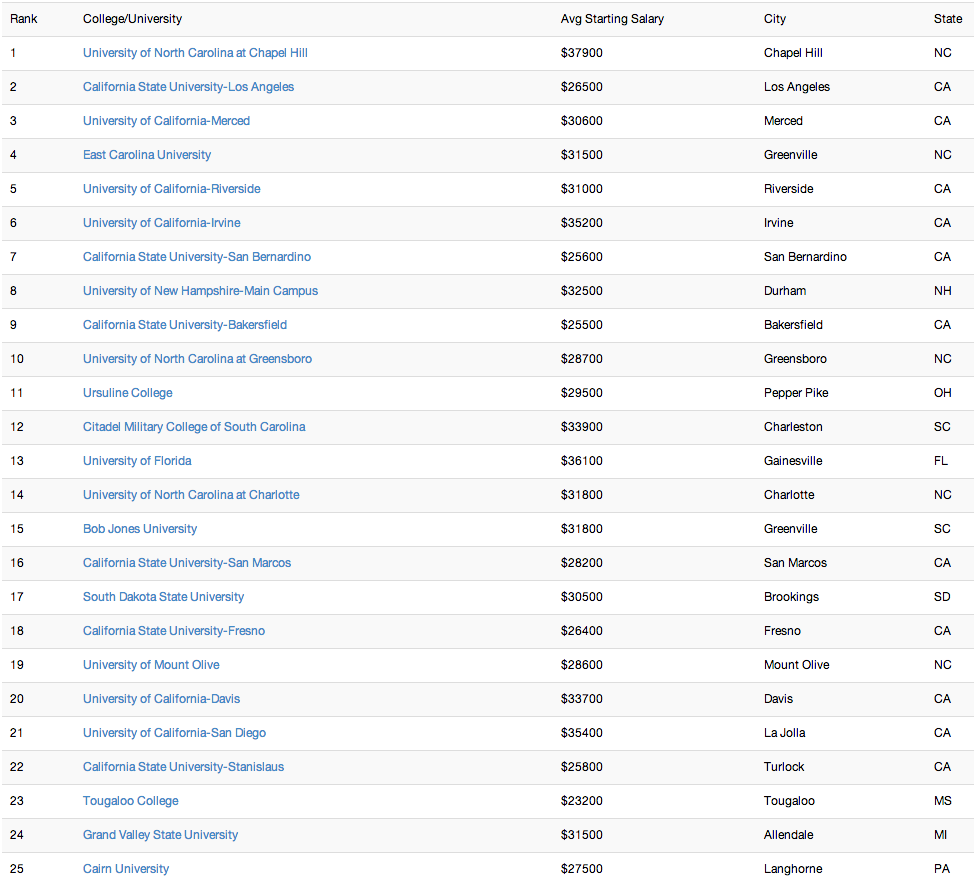

There’s no perfect method for ranking colleges, and every media organization that releases a list has its own standards and criteria.

We tend to focus on lists that take a college’s value compared to its cost into account and which colleges leave their graduates with little student debt.

That’s why we’re intrigued–and a little surprised–at these latest rankings from Time Money. The newsmagazine recently ranked 1,500 four-year colleges by which colleges offer the most bang for your tuition buck.

College costs are rising, but it doesn’t mean there’s no way to avoid taking out excessive student debt in order to finance your education. Here are 7 ways to reduce college costs from the Christian Science Monitor. 1. Attend a zero-tuition college Believe it or not, there are still a few colleges that charge nothing […]

With college costs reaching record levels and still rising, the idea of free college might sound like a pipe dream. Some colleges offer free tuition to the very top students, but these scholarships are extremely competitive. And even with financial aid, most students usually end up paying large amounts for college and taking out student loans. […]

It’s not easy to quantify how much a college degree is worth in dollars. While we know that college graduates make $830,000 more by retirement on average than their less-educated peers, that number can vary widely by individual, college, major and more.

And of course, there are many intangible benefits to going to college. But with costs topping $60,000 at some colleges and continuing to rise, more students and families are realizing they need to consider a college’s future value when determining where to invest their tuition dollars.

A new college-ranking system makes that easier by ranking colleges based on how much better off graduates are financially once they earn a degree.

It’s no secret that college tuition has risen dramatically over the past two decades. According to the College Board, the average cost of tuition and fees for the 2013–2014 school year was $30,094 at private colleges.

But the news that 50 colleges now charge more than $60,000 per year, according to Business Insider, makes that $30,000 bill look like a bargain.

Student debt remains an enormous societal and economic problem, with the average college graduate leaving school with $29,400 in loans, according to College Access and Success. It would be one thing if these graduates were entering an economy with many high-paying jobs available, but that simply isn’t the case, Charles Stevens writes in a fantastic […]

Many of the nation’s top universities, such as Harvard, Stanford and Duke, are lauded for having need-blind admissions policies, meaning they don’t take into account a student’s ability to pay for college when making admissions decisions. These schools say the policy a way to make sure the best students are accepted because of their merit, […]

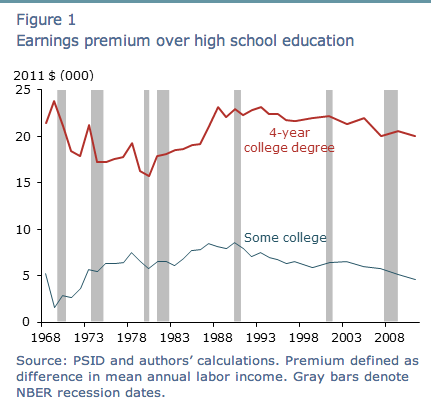

We’ve stressed that a college degree is a good investment despite its high cost. Now, we know exactly how much it’s worth: an extra $830,000 in your pocket, according to the Federal Reserve Bank of San Francisco. College grads earn 61% more per year According to the study, college graduates earned on average about $20,050 (61%) more […]

With college tuition rising every year and student debt at an all-time high $1.2 trillion, it’s not surprising that students and families have begun to question whether college is actually worth the cost.

Most likely due to high costs, high school graduates are choosing to forgo college in favor of working. But at what cost?