Given the consistent rise in the cost of college over the past two decades, it’s no secret that student loan borrowing and student debt are at all-time highs.

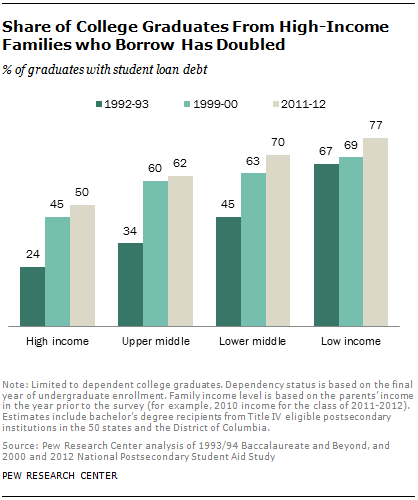

As you might expect, the percentage of students from low-income families who take out student loans to pay for college is greater than their higher-income counterparts, with 77% of low-income students borrowing for college in 2011-12 vs. 50% for high income students.

However, according to Pew Research Center, the rate at which students from more affluent families are borrowing is increasing faster than that at which low-income students are taking out student loans.

If you’re looking to go out of state for college but don’t want to spend the money on a private college, considering some low-cost public colleges is a great idea. Depending on where you live, you may find that these colleges are even cheaper than a public college in your own state.

Check out the list below from U.S. News for the top 10 colleges in the United States with the lowest tuition for out-of-state students. They may not be as well-known as some of the bigger-name schools, but they can provide a quality education at an affordable price.

As parents of college-bound students know, applying to college is more than a financial decision–it’s an emotional one as well. Our founders Rick Ross and Andy Leardini recently appeared on Winging it! Buffalo Style to discuss the challenges families and students face when choosing a college and figuring out how to pay for it. Taking the emotion […]

As college students know, buying textbooks can add thousands of dollars to your college bill before you’ve even taken a class.

While textbooks are often a ‘necessary evil,’ they don’t have to put you even further into debt.

Watch this video from WWLP, and read our tips below for 7 ways to save money on college textbooks.

Reducing college costs doesn’t just happen once the kids have already been accepted. Planning early is the best way to reduce your college costs later on.

In this video from THV11 News, Little Rock Family Magazine editor Heather Bennett shares her five best to reduce college costs while your student is still in high school.

Check out our tips and watch the video to find out more.

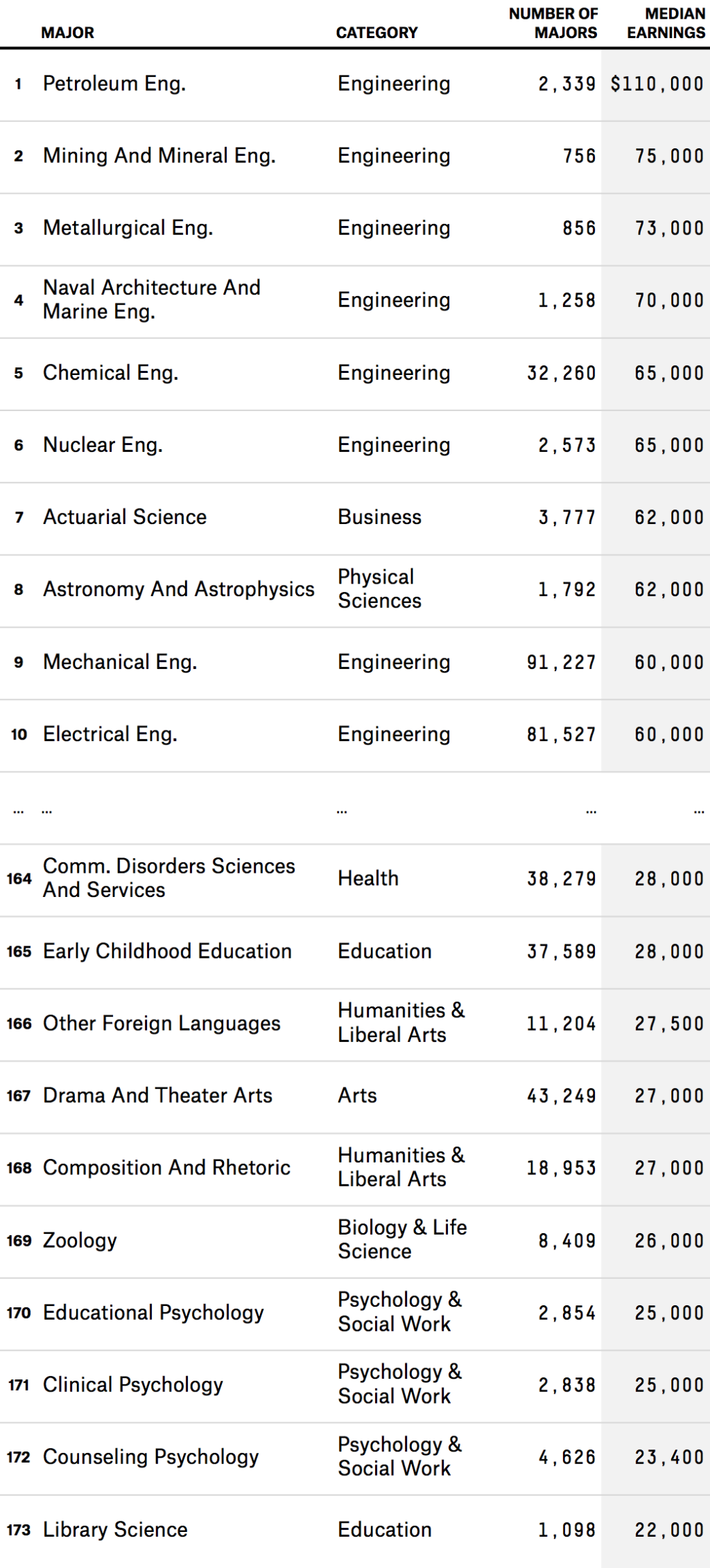

While the return on value of a college degree is at an all-time high, according to a recent analysis by FiveThirtyEight, not all degrees are created equal. As we’ve written, the return on investment of a college degree depends on many factors, including the field of study, student’s debt level, and what the graduate does with […]

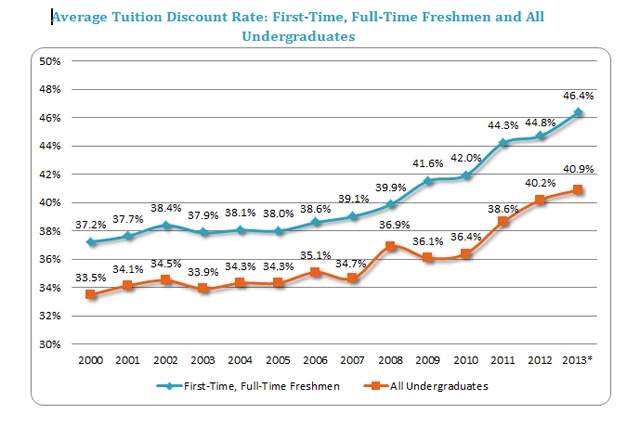

While college costs have increased rapidly over the past few decades, financial aid, grants and scholarships have increased significantly as well. In fact, at some colleges, these tuition “discounts” have been so large that colleges are struggling financially, Jon Marcus reported in a recent Hechinger Report article. College costs are up, but so is financial aid According […]

College costs have gotten out of control, but rarely do you hear a college administrator take responsibility for rising costs. Instead, they announce tuition increases with promises that they’ve “increased financial aid.” But Mitch Daniels, President of Purdue University, isn’t like most college administrators. In a recent appearance on CNBC, he blamed colleges themselves for […]

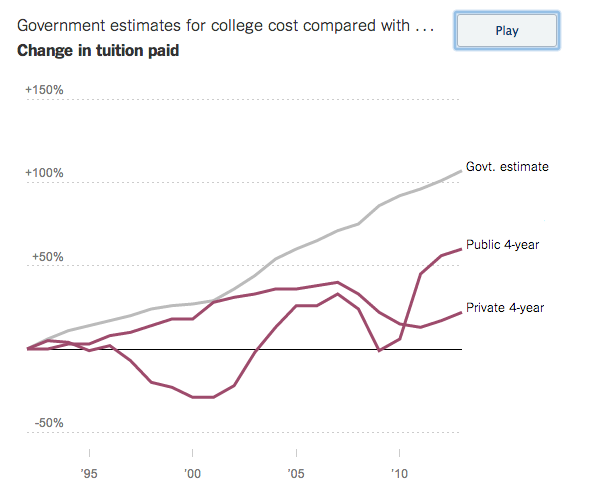

The general consensus among the public is that the cost of college has risen dramatically over the past few decades. We’ve reported how much the rise in college tuition has outpaced gas, cars and any other household item that the government tracks. According to the government, college tuition and fees have risen a shocking 107 percent since […]

We recently wrote about a new set of college rankings based on which colleges provide the best value for your money.

A few states dominated the list and were home to several colleges that provide students with a great bang for their tuition buck. Watch the video to find out what they were.