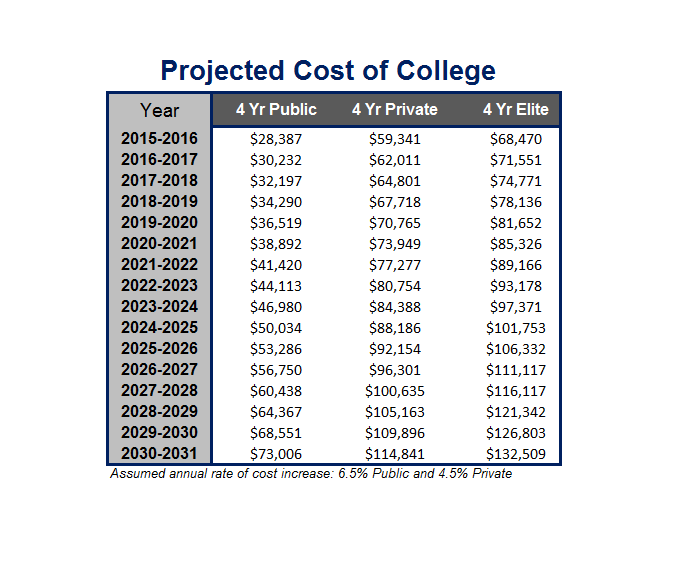

As if college weren’t already expensive enough. A new report from Forbes projects that the cost of four years at a private college could rise to $334,000 for students starting college in 2018.

Considering that’s less than four years away, that’s a pretty huge spike from the already-high current cost of attending a private college. The average cost of attending a four-year private college is now over $59,000 per year, or $254,000 over four years, based on projections that have the cost rising 4.5% each year.

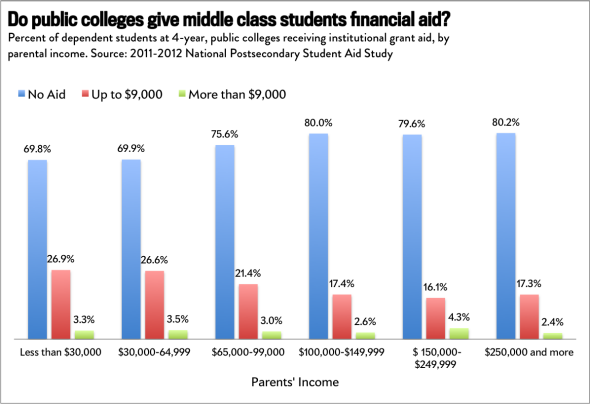

It’s a common myth that financial aid is only for low-income students, and if you make too much money, you have no chance of receiving financial aid.

But according to a recent analysis by Slate, this couldn’t be further from the truth.

In fact, both public and private colleges award financial aid to a significant percentage of middle-class students.

We’ve touted community college as a way to significantly reduce college costs, by transferring to a 4-year college after two years to earn your bachelor’s degree.

And a new proposal President Obama announced today makes community college an even more financially responsible option. The plan, called “America’s College Promise,” would make two years of community college free for eligible students of all ages.

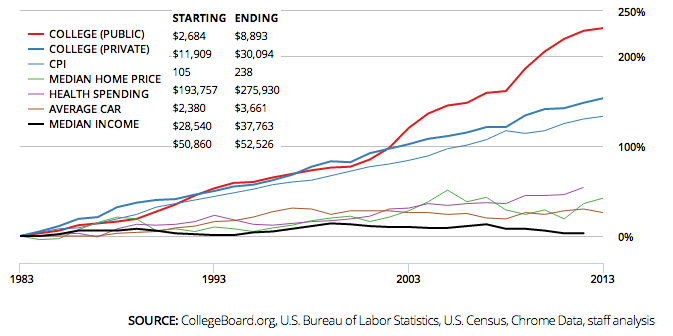

As college costs have risen significantly faster than the cost of other goods and life purchases over the past two decades, many have questioned how colleges can justify the increased burden on students and families. While financial aid has increased to help students afford college and programs such as Income-Based Student Loan repayment have been touted […]

People are always telling parents to put away money for their children’s college education, especially with the cost of college rising so quickly over the past two decades.

But it’s not always easy.

Between the mortgage, car payments, and other expenses, many parents find it nearly impossible to save money for college. And most aren’t even sure how much to save, especially when they’re trying to save for retirement at the same time.

With the cost of college topping $60,000 at some schools, it may seem impossible for regular families to afford higher education.

But there are still plenty of quality colleges for half the cost. Kiplinger recently released a list of the best value colleges that still cost under $30,000 per year, all of which provide a great bang for your tuition buck.

Everyone knows college costs are up, but how does that rise compare to the increase in prices of other life purchases, like cars, housing and consumer goods?

This chart shows how the rise in college tuition at public and private universities compares to the increase in cost of items in the consumer price index (CPI), homes, cars, and healthcare as well as the median income.

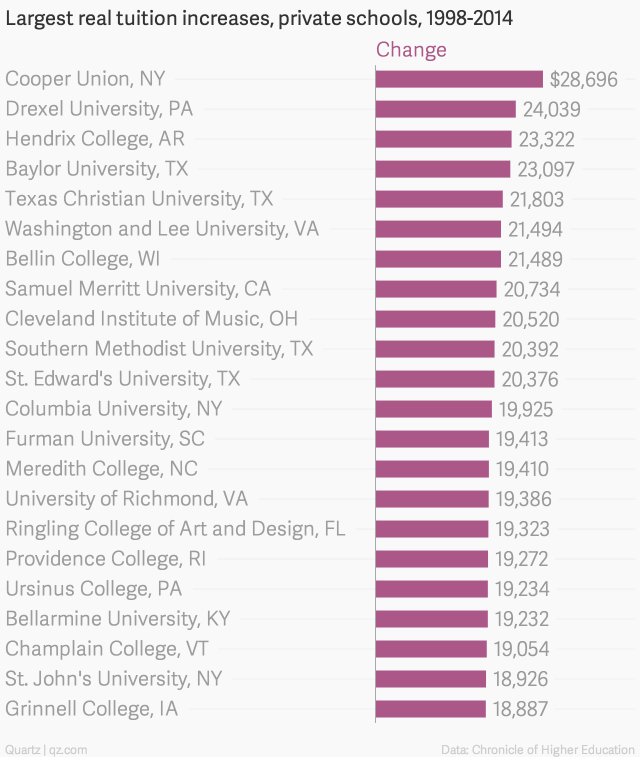

We’ve written extensively how college costs, both public and private, have risen dramatically over the past two decades and continue to rise each year.

While nearly every college has raised tuition, some have increased much more than others. The charts from Quartz rank public and private colleges by the largest tuition increases in 2014 US dollars, after adjusting for inflation.

We’ve expressed that the value of your college degree is influenced heavily by several factors, including choice of major and how much debt you take on to pay for it.

And now a new calculator from The Hamilton Project makes it easier for college-bound students to understand how much their degrees will cost them over time depending on major, student loan debt, interest rates, and term of the loan.

Four years at college is pricy enough, with the average cost of one year at a 4-year private university topping $40,000 and $18,000 at public universities. Over the course of four years, those costs really add up. But the majority of American college students doesn’t even finish their degree in that time, according to a new report […]