We work with many students who think that if they can just get into an elite college, their future prospects and lives will be better. But according to a new survey, this isn’t necessarily the case. In fact, it’s even possible that attending an elite college could make your life worse–if you take on significant […]

College admissions offers are out–and despite college applications being down at some colleges, it was a tough year to get into college.

Especially if you applied to Stanford. The college accepted a record-low 5 percent of its applicants this year.

Applicants to other top colleges like Yale University, the University of Chicago and the Massachusetts Institute of Technology didn’t have it much easier. The colleges accepted 6.3, 8 and 8 percent of applicants, respectively.

Many top colleges received fewer college applications this year than in previous years. This has alarmed some education advocates worried about students not graduating high school, going on to college and getting their degrees.

Even the elite Ivy League colleges aren’t immune to this trend. Applications at Dartmouth College declined a whopping 14% for the Class of 2018 and were down 2.1% at Harvard University.

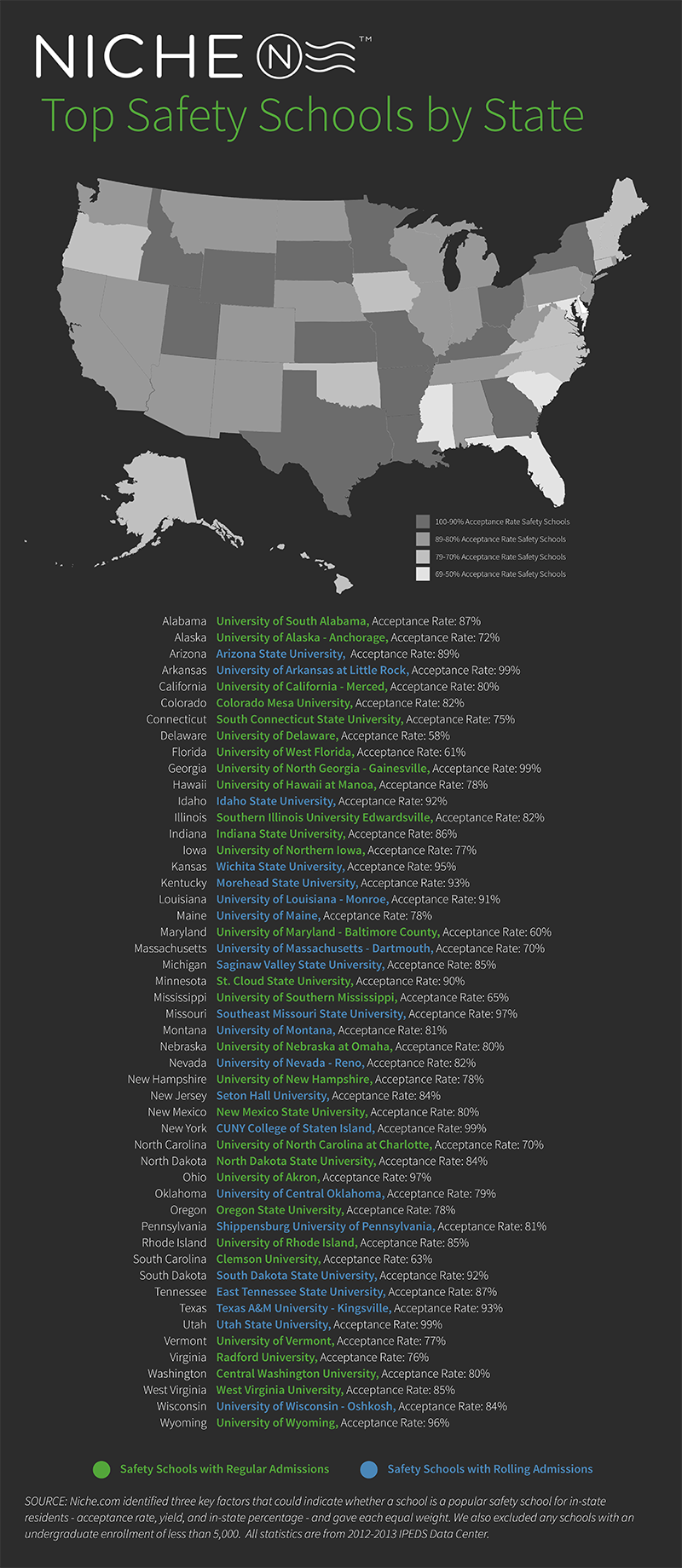

‘Safety schools,’ or colleges considered back-ups to students’ top choices, get a bad rap.

But as many students have found, attending a college that isn’t your first choice can be a great way to save money and avoid student loan debt.

Hechinger Report recently published a great opinion piece from Karen Gross on the ‘flawed conversation’ regarding the cost of higher education. She says that too much public focus is placed on the hard costs of college, and not enough on the repercussions of taking out student debt and alternative repayment options for students. We couldn’t agree more with her claims. […]

How do colleges decide which students should receive financial aid and how much they should receive? Despite the increase in colleges using net price calculators and other reforms to make the process more transparent, financial aid remains a mystery to parents and students–it’s still a “apply, wait and see” type of game. Now, colleges are […]

Just when you thought you had the format down, changes are coming to the SAT.

The reason for the changes, according to David Coleman, president of the College Board, the organization that creates and administers the SAT, is that the SAT and ACT have “become disconnected from the work of our high schools.”

We see a lot of students get their heart set on one particular college, only to end up disappointed when they realize they can’t afford it.

As much as parents may try to reason with starry-eyed students, it can be difficult for 17- and 18-year-olds to understand the long-term impact of significant college debt.

This infographic from Affordable Online Colleges shows the benefits of looking beyond your dream school and remembering that prestige isn’t everything when it comes to choosing a college.

Whether you or your child is preparing for college or already enrolled, your family can benefit from working with a financial aid consultant to save time and money on college.

Here are 9 reasons you should consider working with a financial aid consultant.

During the college admissions process, the cost of standardized testing, test prep services, college applications, and college visits can really add up.

And that’s before you even start thinking about paying for major expenses like college tuition, fees, textbooks, room, and board.

With college such an expensive investment, you may be wondering why anyone would pay someone just to help them figure out how to pay for it.