Stay healthy, millennials. Retirement’s a long way away.

Millennials: have the stresses of work life got you looking forward to retiring on a beach somewhere?

You’re going to be waiting a while.

How student loans affect retirement

A new report from financial website NerdWallet says student loan debt could push the average retirement age to 73.

That’s 12 years later than the current average retirement age of 61.

Of course, factors such as debt load and income will influence how much graduates are able to contribute to their retirement savings and could reduce this age or push it even higher.

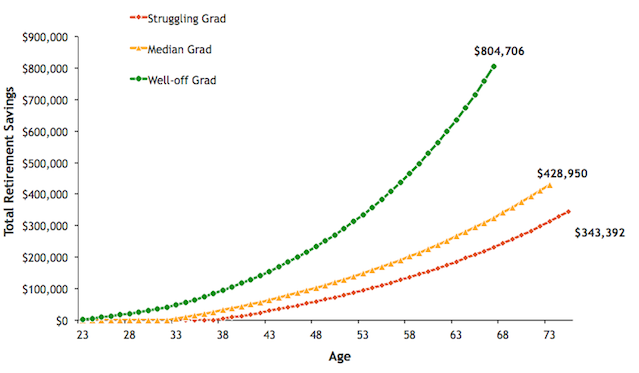

That’s because the more money you make, and the less you have to pay toward student loans, the more you can put toward retirement. These retirement contributions earn interest and grow over time, so the earlier you can start saving, the better off you’ll be.

How student loans affect retirement outcomes

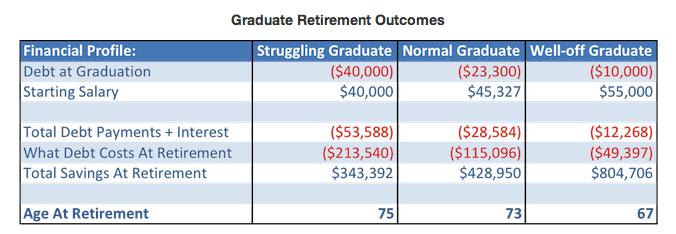

The average college graduate today graduates with $23,300 in student debt. Doesn’t seem that bad, right?

Not so fast. Consider that 7% of a student’s earnings go toward yearly student loan payments of $2,858 for the first ten years of his or her career. According to the report, this prevents any significant contributions toward retirement.

By age 33, when the typical college grad has finally paid off their loans on the standard repayment plan, he or she can only be expected to have saved $2,466 for retirement. This is over $30,000 less than if the student had graduated with no debt.

The median debt load of $23,300 will cost students over $115,000 (in today’s dollars) by the time they retire.

If this money had been saved for retirement instead, it would have been earning a compounded rate of return every year until retirement. At the projected retirement age of 73, the lost savings directly attributable to student debt is $115,096, nearly 28% of total retirement savings.

Having less student debt and a higher salary could give you a few more years to enjoy retirement. A “well-off grad” with $10,000 in debt and a $55,000 starting salary out of college can expect to retire at age 67. A “struggling grad” with a $45,000 debt load and $40,000 starting salary, however, would have to wait until age 75.

Millennials need to save early and often

So what can millennials do?

The outlook is grim, but millennials don’t have to stand back and accept their fate.

The avoid postponing retirement, millennials need to be prepared to make above-average contributions to their retirement accounts. That means being frugal and sticking to a strict budget, both during college and after. The faster you can pay off high-interest student loans, the earlier you can save for retirement and the more those savings will grow.

According to the report, employer 401(k) matches will be crucial for this generation and will compose 50% of retirement savings. If your company has a 401(k) matching program, be sure you’re taking advantage of it.

And if your company doesn’t offer one, make sure you set up your own retirement account. Investing involves more risk than a traditional savings account, but the returns are significantly greater.

How to budget for student loans

If you have any questions about repaying your student loans or need help figuring out how much you should pay, feel free to give Rick and Andy a call at 1-888-234-3907 or send us a message.

photo credit: Eustaquio Santimano via photopin cc

college debt, college loans, debt, repaying student loans, repayment, retirement, student debt, student loan debt, student loan repayment, student loans, unemployment