A breakdown of 4 student loan repayment plans

Student loan repayment can be extremely confusing for new graduates and their parents. With so many different plans and options, it can be difficult to figure out which one is best for you.

US News recently published a helpful breakdown of the four student loan repayment plans that are income-driven, meaning that your payments are dependent on how much money you make.

These plans include:

- Income-Based Repayment

- Pay As You Earn

- Income-Contingent Repayment

- Income-Sensitive Repayment

All of the names may sound similar and confusing, but their post does a great job of explaining the differences and criteria for each of the plans. Most borrowers will not quality for Income-Sensitive Repayment, as this plan is only available to borrowers with Federal Family Education Loan Program loans, which has not issued new loans since July 1, 2010.

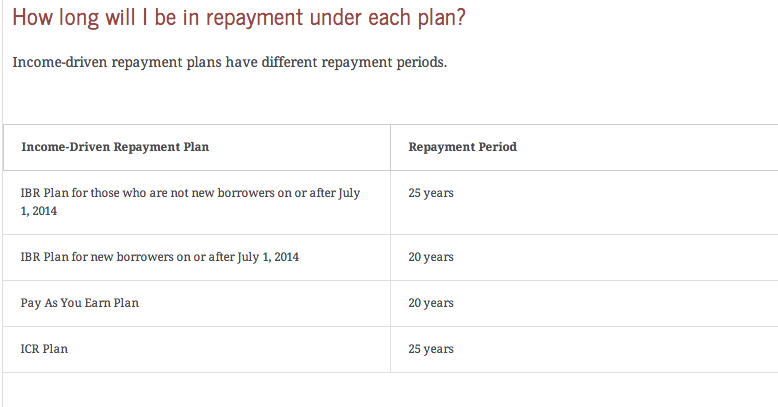

You can also check out this page from the Office of Federal Student Aid to figure out the best plan for you. In the chart below, you can see how repayment periods vary depending on which plan you choose.

If you’re not sure which plan is best for you but need help lowering your student loan repayments, we can help. Feel free to give us a call at 1-888-234-3907 or contact us here.

college debt, loan repayment, repayment, repayment options, student loan debt, student loan delinquency, student loan repayment, student loans