1 in 5 students don’t apply for financial aid

We write often about the importance of applying for financial aid, even if you don’t think you’re qualified to receive it.

But a new study from the National Center for Education Statistics (NCES) found that 1 in 5 students don’t apply for financial aid at all.

Many students neglect to apply for financial aid

The study was based on data from the 2011–12 National Postsecondary Student Aid Study (NPSAS:12), a large national survey of students that focuses on how they finance their education.

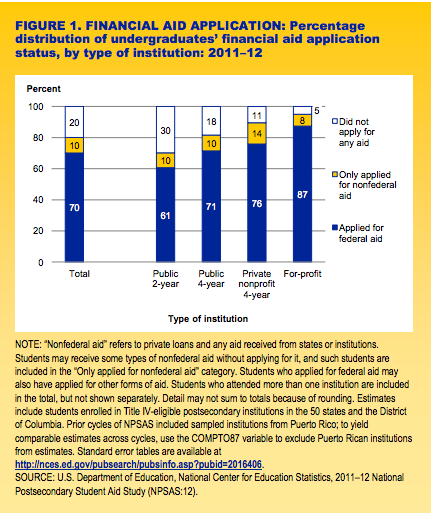

The percentages of students who said they didn’t apply for financial aid varied greatly by type of institution attended: 30% of students at public 2-year colleges did not apply for financial aid, while only 5% of students attending for-profit institutions did not apply.

At public 4-year colleges, 18% of students did not apply for aid, while only 11% at private nonprofit 4-year colleges did not.

Why students don’t apply for financial aid

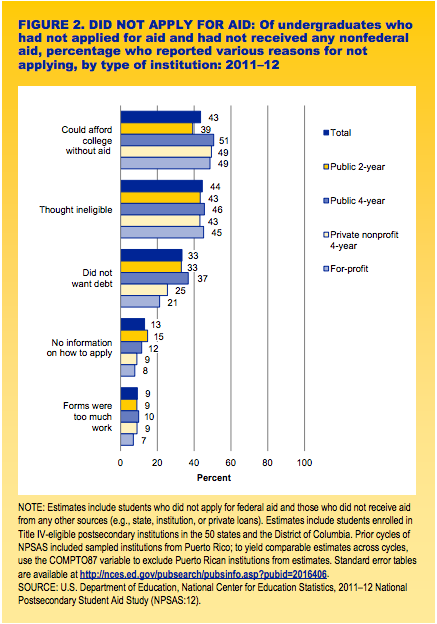

Overall, students’ reasons for not applying for financial aid varied, with the top reasons being that they thought they could afford college without aid (43%) and that they were ineligible (44%).

Another top reason listed by 33% of students who did not apply for financial aid was that they did not want student debt.

These findings are troubling because the majority of students do receive some sort of financial aid for college–and it’s impossible to know how much (and what forms of financial aid) you’ll receive until you apply to and are accepted by a college.

How to maximize your chance of receiving financial aid

Nationally, over 70% of students receive some sort of financial aid at 4-year colleges, but only a very small percentage (just 10% of students in the survey) receive financial aid without applying for it.

So if you wanted to maximize your chances of receiving financial aid, you must fill out the Free Application for Federal Student Aid (FAFSA), as well as any other forms required by the colleges to which you’re applying.

Even if you have a high Expected Family Contribution (EFC), you may be awarded institutional merit and/or need-based aid from the college you apply to. You may also be able to apply for additional scholarships and/or grants.

But at many colleges, you have to fill out the FAFSA in addition to other forms such as the CSS Profile or school-specific applications in order to be eligible.

And for students worried about student loan debt, you don’t have to accept the student loans you are offered as part of your financial aid package. Don’t let your fear of debt keep you from missing out on other forms of financial aid you don’t have to pay back, such as grants, scholarships and work study.

Fill out the FAFSA for financial aid

When it comes to financial aid, it never hurts to apply. It costs nothing to fill out the FAFSA, and it can be done in as little as 20 minutes.

And this year, the FAFSA will be available starting October 1, which will give students and families even more time to fill it out and apply for financial aid.

We help students and families–even those who don’t think they’ll be eligible for aid–get the most financial aid possible and make college affordable.

If you’d like to learn how we can help you, send us a message or call us today at 1-888-234-3907.

affording college, fafsa, financial aid, financial aid counseling, grants, paying for college