We’ve written about the consequences of not paying your student loans, such as having your wages garnished and your credit damaged.

But it turns out the repercussions could be much higher. According to the NY Daily News, a man in Houston was recently arrested by seven U.S. Marshals armed with automatic weapons for not paying a $1,500 student loan from 1987.

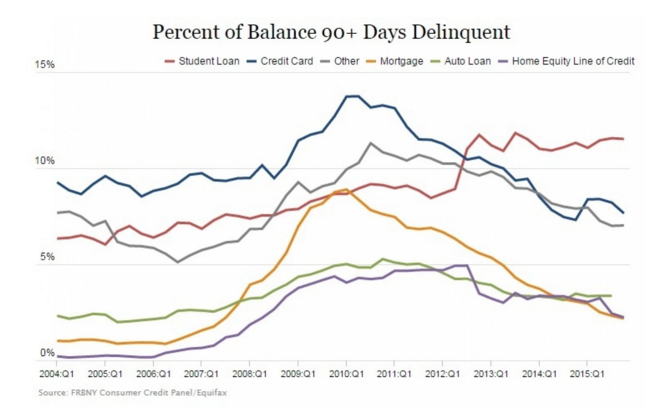

Despite the many alternative repayment plans available, Americans are behind on their student loans more than any other kind of debt.

A new report from the Federal Reserve Bank of New York finds that borrowers are having a much harder time paying off their student loan debt than their credit cards, mortgages, and car loans.

What would you do if you could have all of your student loans paid off?

A lot, most students say, including taking a punch from boxer Mike Tyson.

With the national student debt now at $1.3 trillion, and thousands of borrowers in default, some borrowers are going to great lengths to avoid paying back their debt–including moving to a whole other country. Hiding from student debt collectors abroad An interesting new article from VICE takes a look at the many Americans who have moved […]

Finding a job right after graduating can be tough. And for graduates with student debt, there’s added pressure to find a job and make enough money to afford student loan payments once their grace period has ended.

Luckily for college graduates in New York state, there’s a new student loan forgiveness program that makes it easier for them to adjust to life after college–without having to repay their student loans.

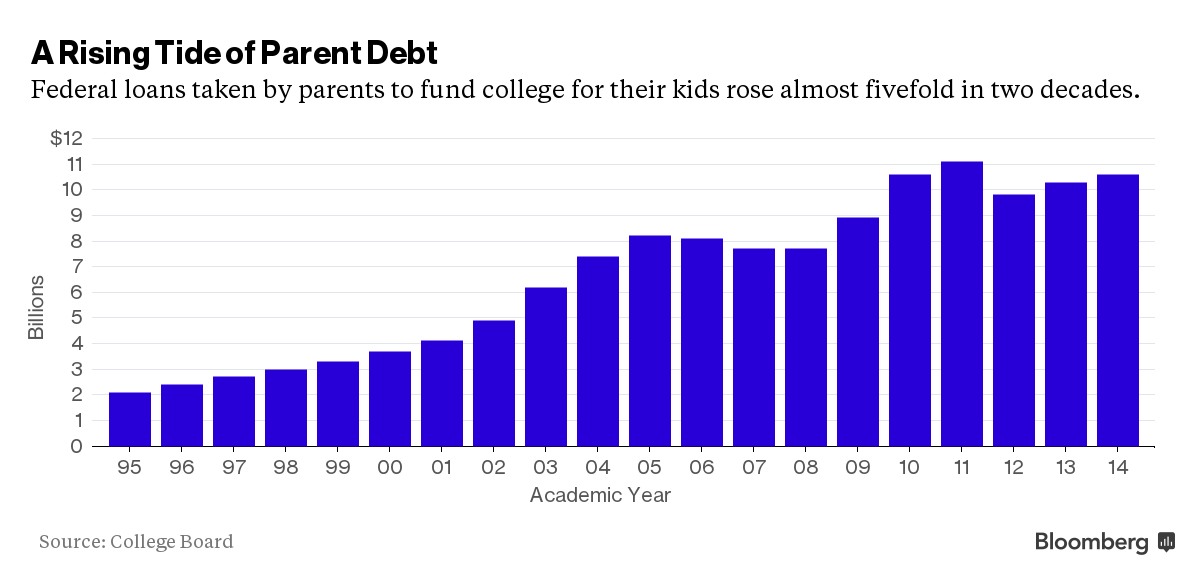

While you hear the most about students borrowing high debt to pay for college, parent debt is usually overlooked–even though it makes up a significant portion of the country’s $1.2 trillion in student debt.

A recent study shows that about 3 million parents have $71 billion in federal student debt, in the form of Parent PLUS loans they took out to pay for their children’s college, according to Bloomberg Business.

Wondering what to get the millennial in your life this Christmas?

Consider giving them something they probably need: a gift toward their student loan payments.

According to MarketWatch, a new site called LoanGifting allows family, friends and others to make payments directly toward someone’s student loans.

The government recently dropped some huge news for those with federal student loans.

Starting Dec. 16, all federal student loan borrowers will be eligible for an alternative repayment plan called Revised Pay As You Earn (or REPAYE), MONEY reports.

As financial aid and student loan consultants, we help families figure out how to pay for college and help graduates manage their student loan debt. Student loan consultancies are on the rise due to high student loan debt, but all aren’t created equal. Some companies have even faced lawsuits for misleading students and taking advantage […]

The average college graduate now leaves school with $30,000 in student debt, and the national student debt total of $1.3 trillion is rising every day. Many prospective college students don’t realize the huge impact student debt can have on their lives–and how much compound interest can add up over time, resulting in a much larger […]