With the cost of college continuing to rise, many graduates are questioning whether their own degrees were worth the investment, according to the Hechinger Report.

Half of college graduates surveyed in a recent Gallup Poll said they weren’t sure whether their degree was worth the money.

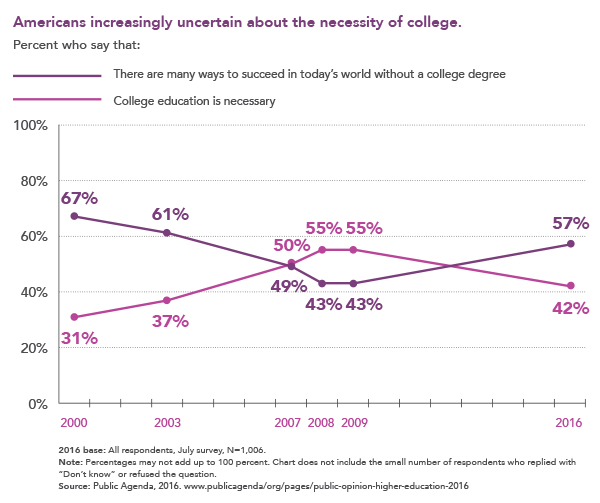

And nearly half of graduates surveyed in August by Public Agenda said a higher education is no longer necessarily a good investment — particularly because of how much debt many students take on in order to pay for their college degree.

Food (and of course, beverages) tend to make up a large portion of college students’ budgets.

But given the high cost of college, students don’t always have a lot of money to pay for meals — especially if they’re not on a campus meal plan that’s automatically added to their college bill.

The video above from NBC News explains how college students on a budget can save money on food costs without feeling deprived.

As we’ve written before, there’s more to rising college expenses than just increasing tuition costs–off-campus housing costs are also skyrocketing, adding to students’ financial burdens even more and forcing them to take on more student debt. And unfortunately, attending a higher-ranked college often means paying more for housing, a new study has found. Elite colleges […]

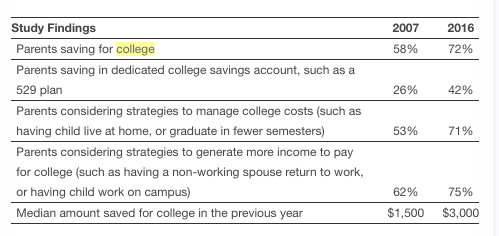

As college has gotten more expensive, more families have made it a priority to save money to put toward their children’s college education.

According to Fidelity Investments’ 10th Annual College Savings Indicator Study, as reported by GoodCall, the percentage of parents saving for college is at an all-time high.

While most of the focus on rising college costs has been related to tuition, there’s another factor that’s driving college students into debt: high off-campus housing costs.

A recent article from USA Today outlined the impact rising off-campus housing costs are having on students.

Millennials may hear their parents reminisce about putting themselves through college by working a summer job and part-time during the school year, but those days are long gone, NPR reports.

NPR broke down the costs of attending college in 1981-82 and how much students would have to work in order to cover their expenses that year. They then compared this to how much students would need to work to pay for college today with a minimum wage part-time or summer job, and the results are striking.

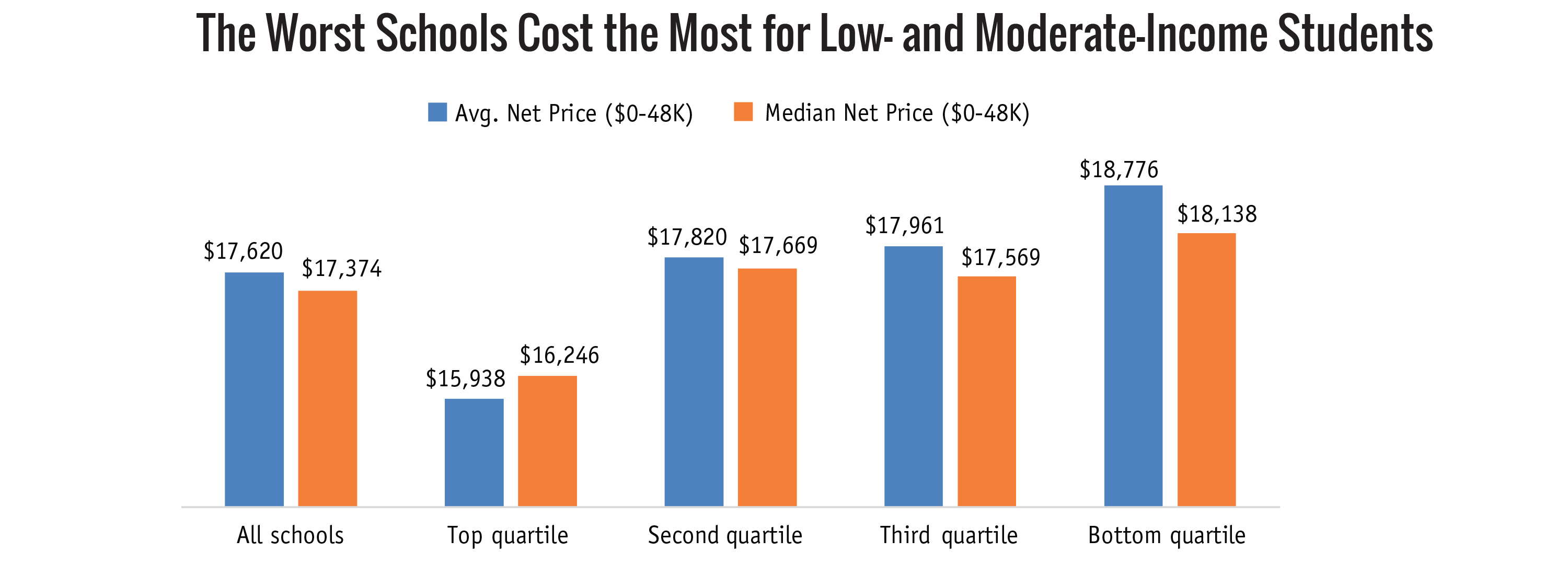

Many students and families assume that the more expensive a college is, the more prestigious and the higher its quality.

This leads some families to overpay for college under the assumption that there is a positive correlation between price and education quality.

But a recent report from Third Way found that that’s not the case.

In fact, they found the lowest-ranked colleges charged low- and moderate-income students more than higher-ranked schools.

We often discuss the dangers of taking on more student debt than you’ll be able to repay. A recent Boston Globe article highlights the difficulty many students, particularly those who are low-income, have with repaying their student loans after graduation. Comparing college net price to graduate salaries In the interactive graphic below, you can see […]

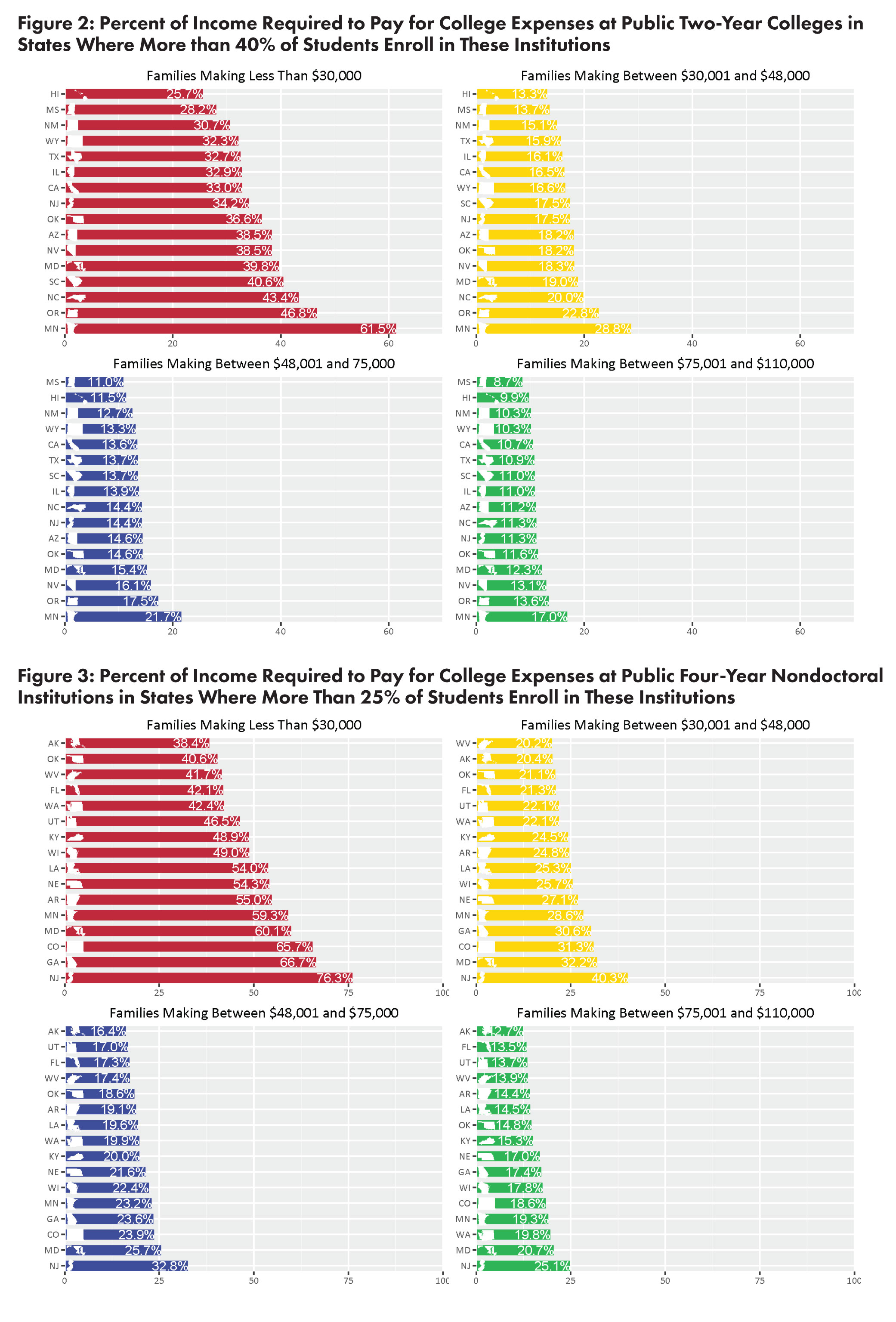

We’ve written previously about how college overall has gotten more expensive, and even though financial aid has reached record levels, it still hasn’t been enough to make up the difference for most families, particularly low-income ones. And a new study from the Institute for Research on Higher Education at the University of Pennsylvania confirms that college […]

With the price of college continuing to rise, some students, particularly those from low-income families, have found themselves struggling to make ends meet. That’s why some colleges in Texas have taken a step to help, by setting up food pantries for students to pick up free groceries, according to The Texas Tribune. There’s a stereotype that most college […]