Few students can afford the high price of college without financial aid. So for prospective college students and families, it’s crucial to know which schools award the most aid before applying to college.

The Princeton Review recently ranked colleges based on students’ ratings of overall satisfaction with their financial aid packages at the 384 best colleges in the U.S. According to their analysis, these are the best colleges for financial aid in 2018:

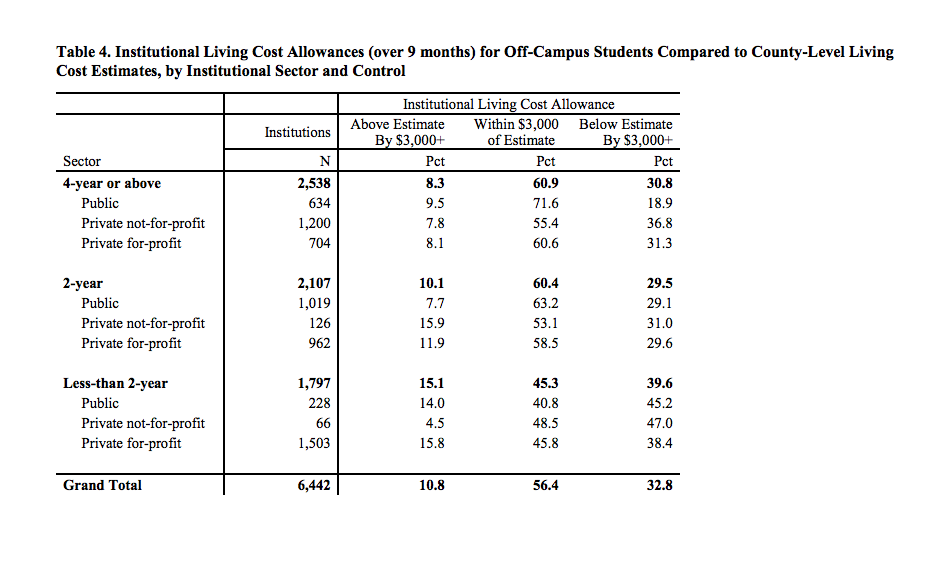

You’re prepared for college. You know exactly how much you’ll have to pay, have borrowed the appropriate amount, and shouldn’t have any unexpected expenses. Right? Not so fast, say researchers. If you planned for college costs using your college’s cost of living estimates, there’s a good chance the amount of money you’ve budgeted will fall […]

As the cost of college has risen, the burden of paying for it has fallen on students more than ever.

CNBC reports that college students are saving an average of $7,801, according to the second edition of the Allianz Tuition Insurance College Confidence Index.

That’s up 17% from $6,678 in 2017.

A new bill passed by Congress will make it easier for student loan borrowers to qualify for student loan forgiveness, CNBC reports.

The bill gives the Department of Education $350 million to offer forgiveness to student loan borrowers who meet all requirements for public service loan forgiveness except that they were enrolled in graduated or extended repayment plans, which were ineligible for relief.

Most people understand that student loans come with interest — which can add several thousand dollars onto the life of the loan, especially if you extend out your payments.

But many people don’t realize that federal student loans also come with origination fees, much like mortgages or car loans, which can add significantly to student debt totals.

Since it’s now been six months since May college graduates left school, it’s time for them to confront the reality of paying off their student debt. The end of the student loan grace period means that students will start receiving bills from their student loan servicers.

Here’s how to take control of your student debt once your grace period is over — and what you can do before to make it easier.

It’s that time of the year: time for college-bound students and their parents should fill out the Free Application for Financial Aid (FAFSA).

Students and parents should complete the FAFSA ASAP for priority financial aid consideration.

Even if you’ve filled out the FAFSA before, there are some big FAFSA changes you need to know about if you haven’t submitted one in the past couple of years.

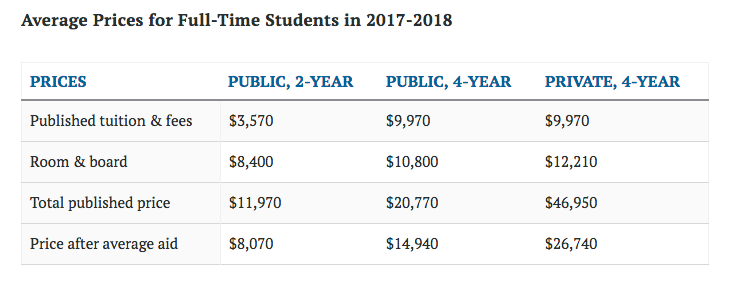

We’ve written in the past how net price — the price you actually pay for college after financial aid, grants and scholarships — is more important than a college’s published price.

Many colleges have high sticker prices, but end up being affordable because they have generous financial aid policies.

Unfortunately, because the rise in financial aid hasn’t kept up with rising costs, the net price of college has risen for the sixth straight year, Money reports.

As of October 1, students can no longer take out federal Perkins Loans to help them pay for college.

The government’s oldest federal student aid program, established in 1957, ended Sept. 30, after Congress failed to extend the program. As a result, up to 500,000 eligible students at 1,500 colleges will no longer be able to take advantage of this financial aid program.

As of October 1, the Free Application for Federal Student Aid (FAFSA) is now available for families and students applying for financial aid for the 2018-19 academic year.

Current high school seniors as well as college freshmen, sophomores and juniors will need to fill out the FAFSA to receive federal financial aid for next year.