Not going to college costs $830,000

We’ve stressed that a college degree is a good investment despite its high cost.

Now, we know exactly how much it’s worth: an extra $830,000 in your pocket, according to the Federal Reserve Bank of San Francisco.

College grads earn 61% more per year

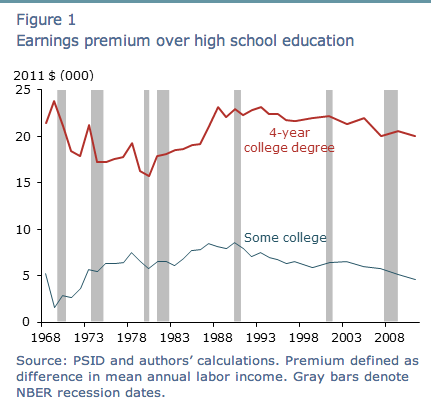

According to the study, college graduates earned on average about $20,050 (61%) more per year than high school graduates.

And by the time college graduates retire, they will have made a total of $830,000 more than a high school graduate.

The average college graduate earns 61% more per year than the average high school graduate. (Source: Federal Reserve Bank of San Francisco)

The authors say that by the time the average graduate turns 40, he or she recoups the cost of a 4-year college education (based on an annual tuition rate of about $21,200).

This figure remains the same regardless of the name or cost of the school. In fact, the authors write that “there is no definitive evidence that [high-cost colleges] produce far superior results for all students.”

Value of a college degree increases over time

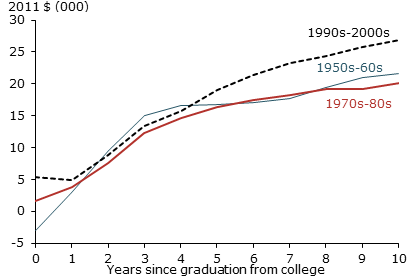

As workers age, the earnings gap between college and high school graduates rises, which contributes to the huge difference in earnings by retirement.

For example, workers who graduated in the 1990s–2000s, the initial gap was about $5,400. Ten years later, the gap rose to about $26,800.

This trend was the same for graduates in the 1950s-60s, as well as the 1970s-80s.

The value of a college degree has not declined over time. In fact, it’s actually risen somewhat for graduates five to ten years out of school.

Not going to college will cost you

If you’re considering forgoing college to save money, you may want to reconsider.

Though it will take some time to earn back the cost of the average college degree, if you work past age 40 you’ll see a positive return on your investment. And when you finally retire, you’ll have seen quite the payoff.

Of course, money isn’t the only reason to go to college. Greater job satisfaction, happiness, and health have all been linked to having a college degree. And of course, the education you receive will stay with you for the rest of your life.

That being said, if you take out significant debt to pay for college and don’t earn much money over the course of your lifetime, you won’t see quite as positive of a return.

That’s why it’s so important to be frugal when borrowing for college and do everything you can to make college more affordable.

college costs, college value, economy, paying for college, return on investment