Young adults struggle to accumulate wealth due to student loans

It’s well-documented that student debt has grown rapidly over the past decade. The class of 2014 graduated with an average $33,000 in student loans per student, and the numbers will likely be event greater for next year’s class.

Given that student loan debt is increasing while salaries are declining, it’s not surprising that many young adults are struggling to accumulate wealth.

Young adults with student debt lag behind

According to a new report from the Pew Research Center, it’s become increasingly difficult for young adults with student debt to save up enough money to buy a house, get married or start building their ‘nest egg.’

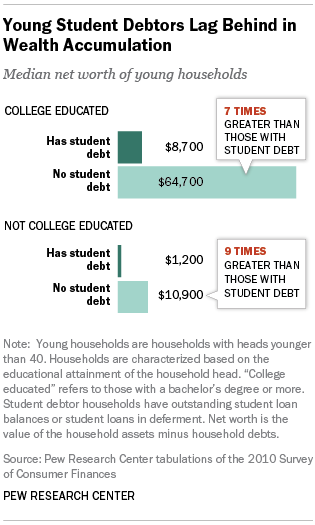

The analysis found that households headed by college graduates who didn’t take out student loans have a median net worth of about $64,700, compared to $8,700 for households headed by college graduates with student debt.

The difference is quite staggering–and demonstrates the profound effect that student loans can have on a person’s life for several years.

Be prudent about borrowing for college

With the cost of college being so high (and potentially affecting one’s economic well-being for decades after), it’s crucial to be extremely prudent about borrowing to pay for college.

Many students and families don’t realize that there are plenty of affordable colleges that offer scholarships and other forms of financial aid while providing a quality education.

And several studies have shown that college prestige doesn’t impact your future happiness or success–but student debt certainly does.

If you’re interested in learning about ways to make college affordable, or need help figuring out how to manage your student loans, give us a call at 1-888-234-3907 or contact us here.

affording college, choosing a college, college value, return on investment, student debt, student loan repayment, student loans