College costs rising fastest for poor students

Despite claims by education leaders and politicians that they’re working to make college more affordable for low-income students, an analysis from The Hechinger Report shows the exact opposite is happening.

Poor students squeezed by college tuition hikes

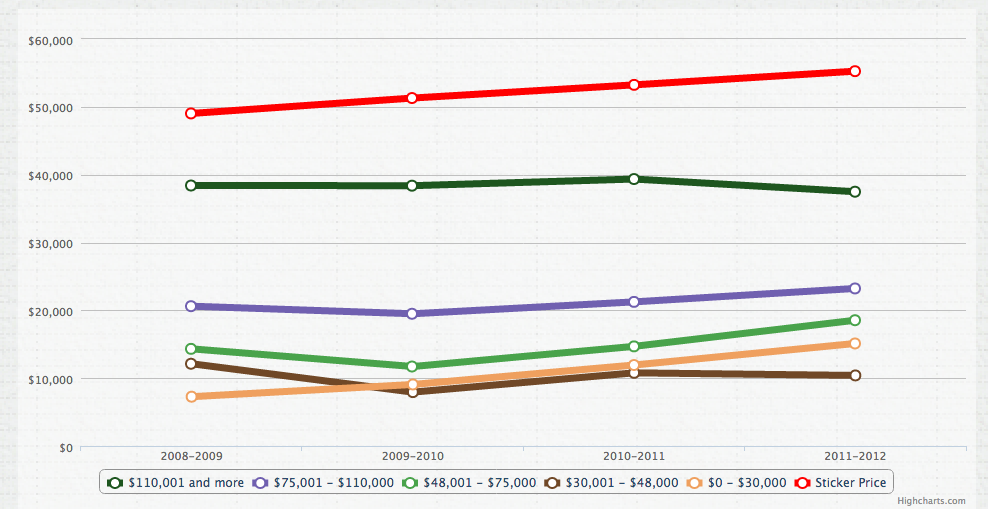

Based on data colleges are required to report to the U.S. Department of Education, the amount lower-income and working-class students at private colleges and universities have had to pay for college after grants and scholarships (the college “net price“) has increased faster than the amount middle- and upper-income students are paying.

According to the analysis, the net price rose for all college students by an average of $1,100 at public and $1,500 at private universities between the 2008-09 and 2011-12 academic years, the most recent period for which the figures are available.

Wealthy students pay more, but costs have risen slower

Even though higher-income students paid more overall for college than their lower-income peers, their costs rose more slowly.

After adjusting for inflation, low-income students saw an increase of about $1,700, while costs rose $850 for middle-income families and $1,200 for those in the top income group.

Making college costs more transparent

Based on these troubling findings and the data, Hechinger Report, in collaboration with Dallas Morning News, Omaha World Herald, and the Education Writers Association, unveiled a new tool, Tuition Tracker, that takes some of the mystery out of college pricing.

The tool compiles data from over 3,000 colleges and universities in the United States and shows the average price families in certain income ranges pay for college–and how that’s changed over the past few years.

The findings are troubling and back up the claims that lower-income students are getting squeezed the most by increasing college costs.

The data below represents the amount students at the University of Notre Dame paid by income level. As you can see, costs rose fastest for students in the lowest income bracket ($0-$30,000).

Colleges breaking promise to help low-income students

This has led education leaders to question whether colleges are holding true to their promises to make college more accessible for low-income students.

Stephen Burd, a senior policy analyst at nonprofit think tank New America Foundation, puts it bluntly.

Schools are talking out of both sides of their mouths. They say that they support access, but in general they’re giving more and more of their aid to higher-income students.

Helping students & families understand financial aid

We couldn’t agree more with Burd’s analysis. The data clearly shows that low-income students are bearing the weight of increasing college costs. We know that colleges are less than upfront about how they award financial aid, and the reason is that they know they’re not really using it to increase college access poorer students–they’re using it to further their own goals.

We consider ourselves advocates for the student and family in the financial aid process, and we support any tools or methods that make the college financial aid process more transparent for our clients, students, and their families.

We’ll be recommending Tuition Tracker to our clients and hope this tool will force colleges to take a hard look at themselves and ask whether or not they’re actually helping students who need it the most.