Popularity of Pay-As-You-Earn Program prompts calls for reform

President Obama unveiled the “Pay As You Earn” program in 2011 as a way to provide relief for student loan borrowers struggling to repay their loans. The plan capped borrowers’ payments at 10% of their discretionary income per year.

After 10 years, for the unpaid balances for those working in the public sector or for nonprofits would be forgiven, while private-sector workers’ debts would be wiped after a 20-year payment period.

For student loan borrowers with low incomes, especially those in the public sector, the income-based repayment plan helps them manage their monthly payments even without a high-paying job.

But the program has had an unintended consequence: the government is taking on enormous debt, while colleges continue to raise tuition, having no incentive to lower costs when the government is footing the bill.

Income-based repayment program growing rapidly

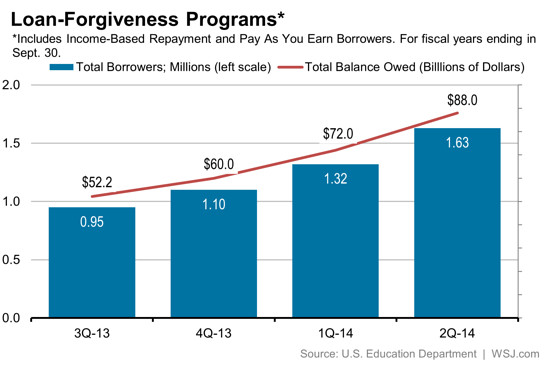

U.S. Education Department records show that enrollment in this plan has surged nearly 40% in just six months, to include at least 1.3 million Americans owing around $72 billion.

While it’s great that borrowers have a way to afford their monthly payments without falling into delinquency, the program has become too popular for the government to afford.

An independent study estimates the future cost of program could hit $14 billion a year, which has prompted President Obama to propose capping the total debt forgiven at $57,500 per student. Currently, borrowers can take on unlimited debt and still be eligible to have its balance forgiven.

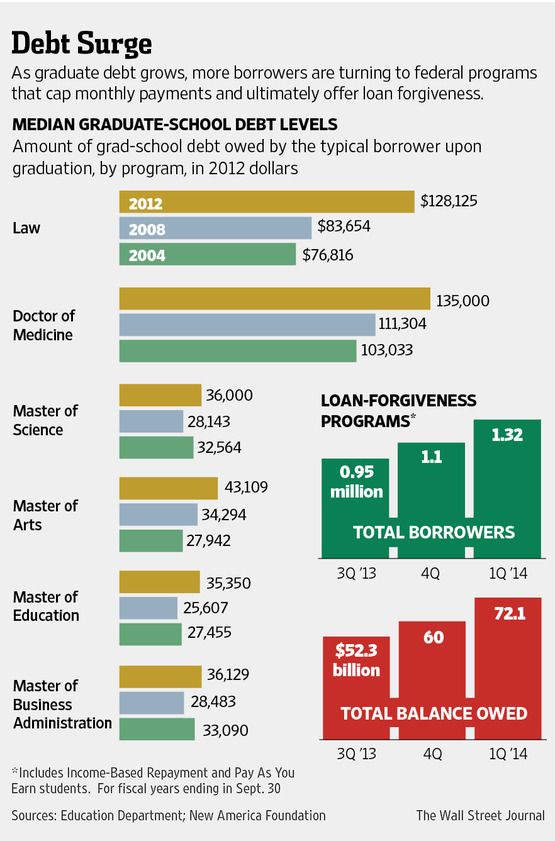

College costs, student debt on the rise

But there are many students who took out hundreds of thousands of dollars in undergraduate and graduate, law, business or medical school debt expecting their balances to be forgiven who would be responsible for paying their debt after 10 or 20 years–debt that has accumulated significant interest due to the borrower making relatively low payments each month under the plan.

And since students know they won’t be responsible for much of the debt, they have no incentive to shop around for an affordable school or avoid taking on enormous debt to pay for college–which gives colleges no reason to keep their costs under control.

College tuition and fees have increased over 6% a year on average in the past decade, more than 2 1/2 times inflation, according to federal data. This has contributed to the surge in student debt, which now stands at an astounding $1.2 trillion.

As Tim Donovan writes in his Salon piece about the subject,

The ‘Pay As You Go’ Income-Based Repayment plan is a particularly ineffective ‘solution’ to our student loan debt crisis; it only helps maintain our dysfunctional, broken system, allowing students to keep purchasing overpriced degrees, safe in the knowledge that they’ll only have to pay what they can afford, while schools keep raising prices without fear that enrollment will ever precipitously fall.

The real problem: college costs

While changing the rules after these graduates were led to believe there would not be a limit on the amount of debt they can have forgiven would be unfair, it’s clear that the program in its current form is unsustainable.

It also doesn’t address the real issue of colleges neglecting to keep their costs under control and pricing out large chunks of the population. While colleges claim they attempt to increase financial aid when tuition rises, the reality is that college is becoming less affordable for everyone, especially low-income students.

In reforming this program, we hope that the administration will recognize the need to force colleges to stop raising tuition and take responsibility for their astronomical costs.

Increasing federal financial aid and forgiving student debt are just temporary Band-Aids on top of the core issue: colleges raising prices without hesitation, knowing that someone else will pay the price–be it the students themselves or the government.

college debt, monthly payments, repayment, repayment options, student debt, student loan debt, student loan repayment, student loans