Minorities and poor college students have the most student debt

Need-based financial aid, particularly in the form of Pell grants, is designed to make college more affordable for low-income students who may not otherwise be able to attend college.

But a new study, as reported by the Washington Post, finds that the students who need financial aid the most are the ones who end up with the most college debt.

Low-income students borrow more for college

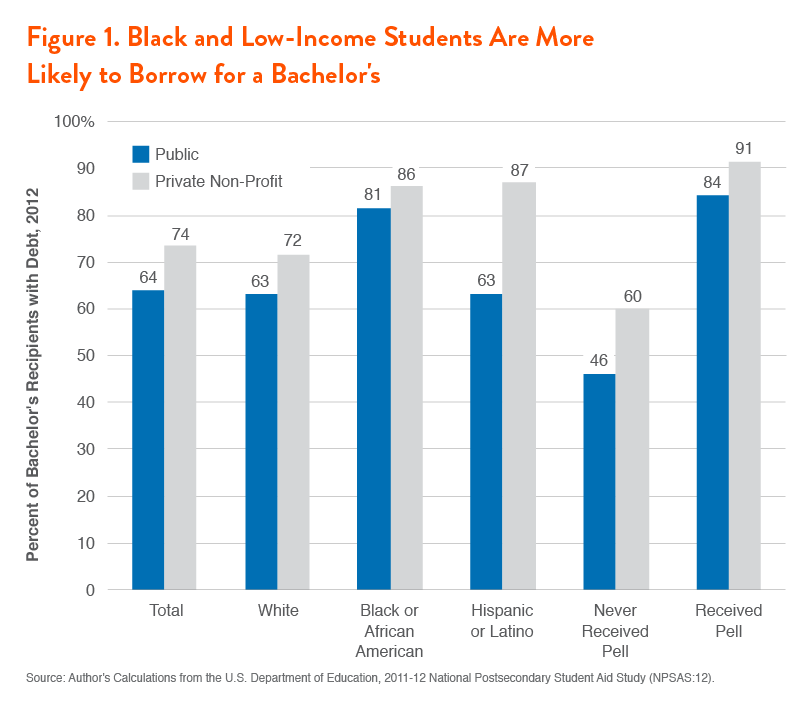

According to a new report from Demos, 84% percent of college students with Pell grants graduate from four-year public schools with debt, compared with less than half of students without these grants.

Pell grants are generally given to students whose families make under $30,000 per year.

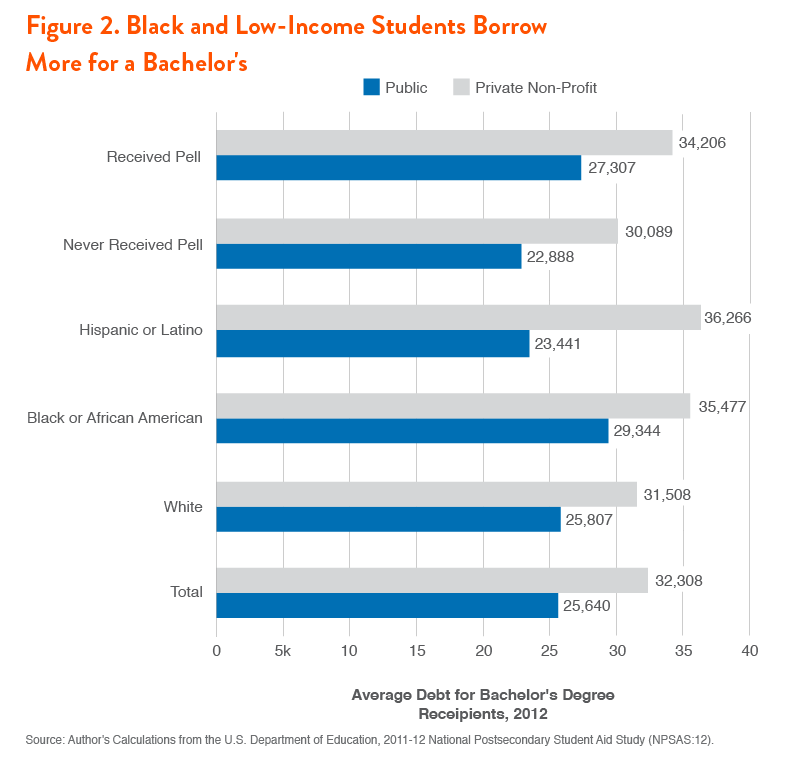

Low-income students not only borrow more frequently; they borrow more money.

The average Pell grant recipient takes out over $34,000 at private non-profit colleges at over $27,000 at public ones, compared to just $30,000 for private and under $23,000 for public for students who did not receive the grant.

And minorities, who make up a large percentage of low income students, have it particularly bad. Their study found that four out of five black graduates take out loans for college, compared to less than two-thirds of white students.

And, as we’ve reported, black students and other minorities who take out student loans graduate with more debt than their peers.

High costs limit college access for poor

What can be done to stop this alarming trend?

Colleges have to go back to living up to their promise–of helping to make college affordable for all, regardless of their background. As many colleges, particularly public ones, have put rankings ahead of this promise, the people who need the help the most have been pushed out, creating “bastions of privilege” at many colleges.

We believe college should be a right–not something reserved for the privileged. We work with families of all backgrounds to help them maximize their financial aid packages and make college more affordable. Compared to other college and financial aid counselors, we keep our rates low because we understand how important money is when your child is going to college.

If you’d like to learn how we can help you figure out how to pay for college and make it affordable for your family, give us a call toll-free at 1-888-234-3907 or contact us here and we’ll get back to you right away.

financial aid, financial aid counseling, low-income students, paying for college, pell grant, student debt, student loans