We’ve written before about how public colleges aren’t necessarily the most affordable choice in the long run. In some cases, private colleges may offer more financial aid than public schools and can sometimes end up being even less expensive.

Not only can attending a private college sometimes save you money upfront, in many cases it can pay off long after graduation.

While the general trend is for college costs to rise each year, some private colleges have decided to buck the trend by significantly lowering tuition costs, according to a recent CBSNews article.

Two dozen private colleges have cut tuition since 2016, according to the National Association of Independent Colleges and Universities.

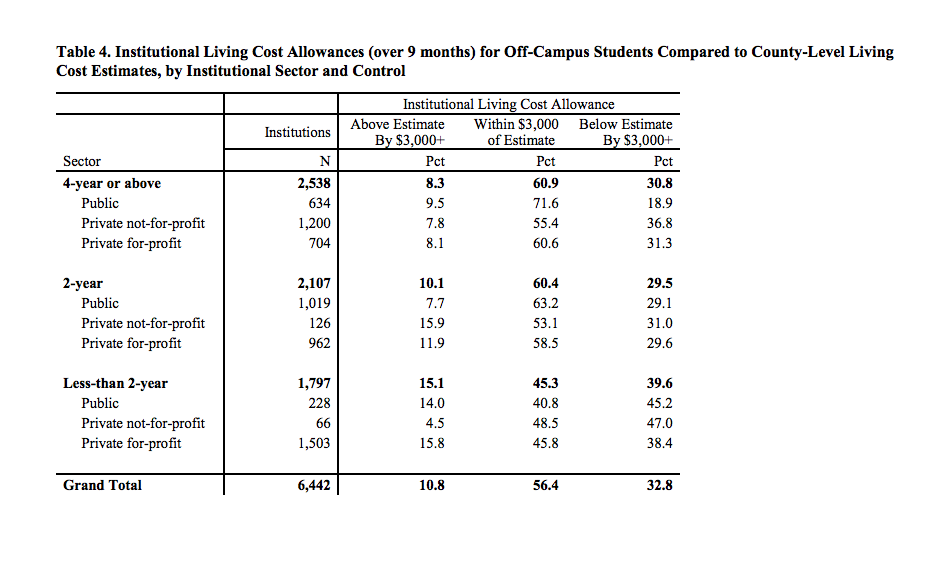

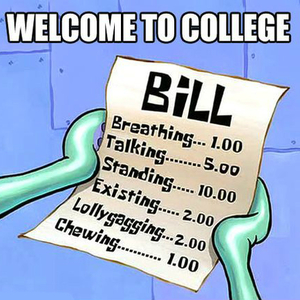

You’re prepared for college. You know exactly how much you’ll have to pay, have borrowed the appropriate amount, and shouldn’t have any unexpected expenses. Right? Not so fast, say researchers. If you planned for college costs using your college’s cost of living estimates, there’s a good chance the amount of money you’ve budgeted will fall […]

As the cost of college has risen, the burden of paying for it has fallen on students more than ever.

CNBC reports that college students are saving an average of $7,801, according to the second edition of the Allianz Tuition Insurance College Confidence Index.

That’s up 17% from $6,678 in 2017.

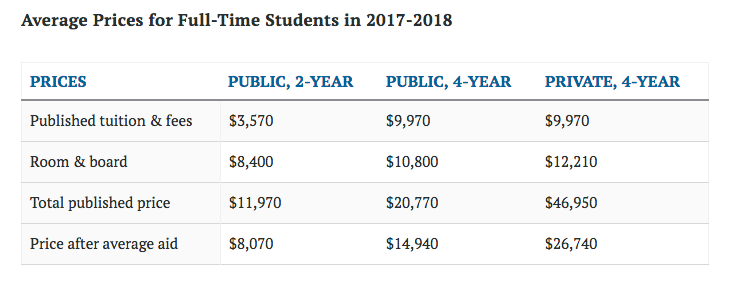

We’ve written in the past how net price — the price you actually pay for college after financial aid, grants and scholarships — is more important than a college’s published price.

Many colleges have high sticker prices, but end up being affordable because they have generous financial aid policies.

Unfortunately, because the rise in financial aid hasn’t kept up with rising costs, the net price of college has risen for the sixth straight year, Money reports.

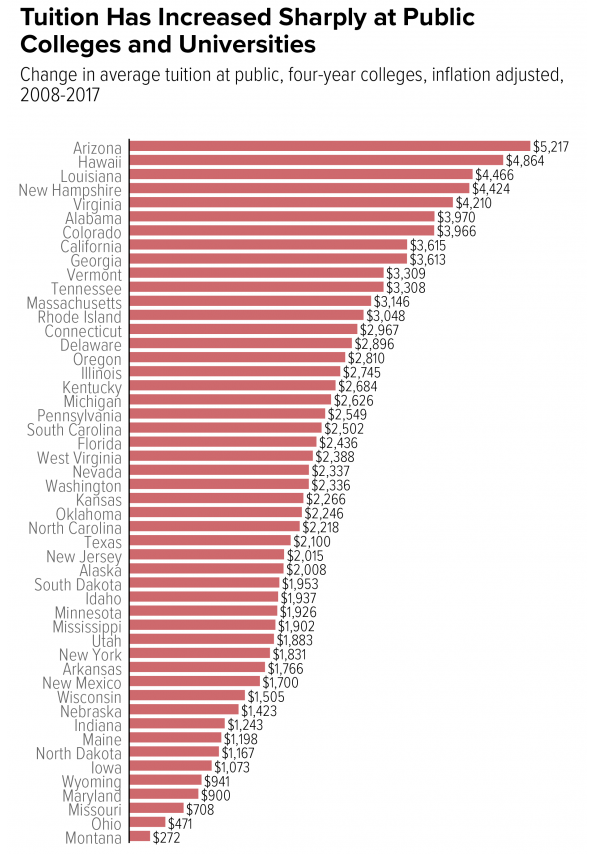

With college as expensive as it is now, public colleges have been touted as a good alternative for students looking to limit college costs.

But, like private colleges, tuition at public colleges across the country has risen rapidly over the past ten years.

Between 2008 and 2017, the average cost of attending a four-year public college went up in every state, even adjusting for inflation, according to a recent report by the Center on Budget and Policy Priorities, as reported by MarketWatch.

Living off-campus and commuting to college can be a great way to save on college costs.

But it’s not always the most ideal for making new friends. One of the downsides of commuting is missing out on the college dorm experience, which facilitates many friendships.

Commuting also comes with some expenses and inconveniences, such as dealing with traffic, extra time spent in the car and transportation costs.

Luckily, there are still plenty of ways to make friends even if you’re not living on campus and reduce the hassle and expense of commuting to college. We’ve put together a list of tips on making commuting to college easier.

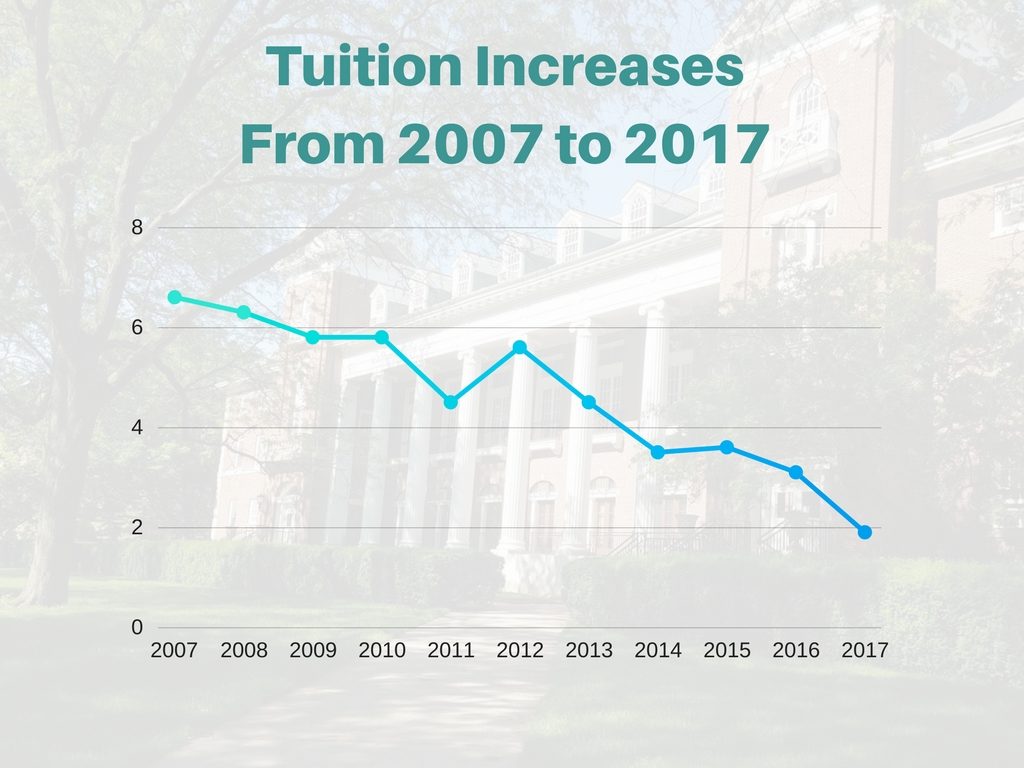

It seems there’s a light at the end of the college cost tunnel.

While college costs are higher than they’ve ever been (and continuing to rise), the yearly increases are, finally, slowing down, according to new data from the Labor Department.

The department found that over the past 12 months, tuition rose by just 1.9 percent–the lowest rate since before 2007, StudentLoanHero notes.

College is expensive enough when it lasts four years. But the majority of college students don’t graduate in four years–and the additional years and courses they take can significantly increase their college costs.

Every extra year a bachelor’s degree-seeking student spends in college costs an average of $68,153 in additional tuition, fees, and living expenses, plus forgone income, Complete College America estimates.

It’s not just tuition and room and board that are causing college costs to skyrocket: college fees are as well, according to The Hechinger Report. In fact, fees have been increasing far faster than tuition, nearly doubling at four-year public universities and more than doubling at community colleges since 1999-2000, according to a recent study. Hidden […]